“Look, doc,” he would say to the surgeon, “I already paid my premiums on the policy. Now I have to pay $320 more. Can’t we do something about it?”

“Well, maybe I can help,” the doctor would reply. “I’ll charge the insurance company an extra $640—we’ll call it complications, or something—and we’ll split it down the middle. After all, the insurance people can afford it. They’ve got lots of money.”

According to many critics, especially in labor and management circles, major-medical insurance and similar programs introduced later by Blue Cross and Blue Shield were good as far as they went, but they didn’t go far enough. Insurance should protect not merely against the big losses but also against the small and moderate losses. It should also cover preventive medicine, routine physical check-ups, and the treatment of a disease in its early stages, before it became a major illness. It should be tied not to the costs of a single illness, but to the costs of all illness in a family during a year.

Here was a demand for comprehensive or all-inclusive health insurance, and at first it filled traditional insurance men with horror. “In this connection,” a Los Angeles insurance man told reporters, “comprehensive is a dirty word.”

To most insurance men, and to many if not most physicians, the whole idea of comprehensive or essentially complete coverage was wrong in principle, economically unsound, medically unethical, and probably Communistic. Health insurance, they insisted, was not supposed to help people budget or prepay the great bulk of their medical bills but to take care of the rare, whopping bill. They said that comprehensive coverage would be wide open to abuse, with patients calling their doctors for every minor sniffle and ache. They said it would mean a deluge of small claims which would be too expensive to handle, and which most people would prefer to pay by themselves.

“The individual,” it was declared by a professor of insurance at the University of Michigan, “would probably save by bearing these piddling losses out of pocket.”

Not all health experts however, agreed with these broad assertions. In New York, George Bugbee of the fact-gathering Health Information Foundation, presented nationwide studies showing that the “piddling losses” of many American families frequently add up to catastrophic totals over a year.

“Many people believe that health insurance really should prepay the great bulk of their medical bills,” he said. “They know it’s not always the big, unexpected illness that breaks the budget.”

He seriously questioned the statements of insurance men that handling small claims would be too costly, and he denied that comprehensive coverage would be necessarily an invitation to abuse and overuse. “Very few persons rush to a doctor just for the fun of it, even when they don’t have to pay,” he said.

Interestingly, there was evidence available from such highly successful group-practice organizations as the Palo Alto Medical Clinic, in California, and the Health Insurance Plan, or H.I.P., in New York, to show that comprehensive health insurance protection—with budgeting of nearly all medical costs—could be provided efficiently and honestly, without abuses. But this evidence was generally ignored in many medical associations, primarily because of claims that prepayment under group practice does not permit completely free choice of physician, and is therefore unethical. In a momentous decision last year, however, the AMA ruled that such group practice in itself cannot be considered improper or unethical.

There was similar evidence from such Canadian groups as Windsor Medical Services, sponsored by medical societies themselves. These groups, which did allow free choice of doctor, also reported essentially no abuses under comprehensive coverage. But this evidence, too, was discounted.

By early in 1955 the demand for much broader protection against medical costs and the apparent refusal of the insurance industry or the Blues to provide it, had resulted in a noisy and dangerous impasse. Spokesmen for many labor unions, trying to help their members meet the rising costs of illness, were angrily calling for governmental intervention. Both Republican and Democratic leaders were seriously considering Federal health-insurance legislation. As in the early battles over voluntary health insurance itself, medical societies were again split by warring factions.

Oddly, it was General Electric—the same group which had pioneered with catastrophic or major-medical insurance—which found a way out of the dilemma.

“We’d experimented with major medical for about five years,” says E. Sidney Willis, of G.E.’s industrial-relations department. “It was good, but it wasn’t good enough. We wanted to find something better.”

What they created has become known as the General Electric Comprehensive Plan. Technically, it was not totally comprehensive. It did not cover everything in medicine. But, as even its critics admitted later, it was getting amazingly close.

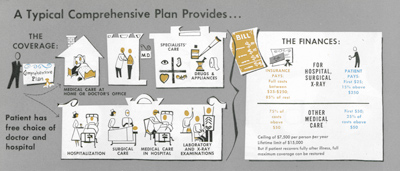

The G.E. men sought to work out a plan, which would protect against the mall bills as well as the big bills. It was to cover practically every service in medicine including home, office, and hospital care. It was to cover drugs, nursing, blood transfusions, X-ray studies, and laboratory tests. It was to provide complete freedom of choice—any hospital, any physician. It was to give the doctor complete freedom to treat the patient as he saw fit, with no restricting time limits or fee schedules.

“We didn’t want a system that would pay a surgeon so much per stitch,” explained Willis.

The new plan, when it was finally laid out, included both deductible and coinsurance provisions. Instead of the usual $200- to $500-deductible for each illness, however, there was a $50-deductible—$25 if only hospitalization, surgery, or diagnostic X-rays were involved—for all illnesses in any one year.

For hospital, surgical and X-ray expenses, once the deductible portion was met, the plan was to pay the next $225, and then 85 percent of the balance. For other medical care, after the deductible was covered, the plan was to pay 75 percent of the rest.

The ceiling was set at $7,500 per person each year, with a lifetime limit of $15,000. If the patient recovered fully, however, he could be reinstated and have his full coverage restored.

There were a few important limitations. For example, the plan purposely did not cover expenses for routine checkups, cosmetic surgery, dentistry, eyeglasses, or hearing aids. There was a top limit of $I50 for a normal delivery, but no limits for complications of childbirth. There was full coverage for mental disease if the patient had to be hospitalized, but only about half coverage if he was well enough to work while undergoing psychiatric care.

Significantly, there was no fee schedule for doctors. The plan allowed the doctor to charge any “reasonable, necessary, and customary” fee. Of equal significance, the plan covered treatment at home or in a doctor’s office as well as in the hospital. There was no temptation for a patient to seek needless hospitalization in order to get his bills paid.

When Willis took his rough plans to Metropolitan Life, which was already handling standard health insurance for G.E. employees, he found a few of the insurance men had already been thinking about the supposedly subversive idea of comprehensive insurance.

“But it could be dangerous,” Richard Shinn, of Metropolitan, told him. “It’ll take a lot of courage to eliminate fee schedules.”

“Maybe,” said Willis, “but I think we can convince the doctors it will really be to their advantage to play ball.”

“O.K.,” said Shinn. “Let’s figure out what this will cost.”

All during the early months of 1955, Willis and Shinn met almost daily to hammer out details and estimate probable costs. Willis also worked with representatives of Aetna Life, which was handling coverage of G.E. employees on the West Coast. When the cost figures were obtained, the premiums—assuming full co-operation by both patients and doctors—came out to about four dollars a month for each single employee, or about fourteen dollars a month for an employee and his dependents. General Electric agreed to pay a sizable share of the premiums and to pick up the bill for excesses in case there were abuses and the cost of the plan skyrocketed.

When news of the proposed program reached the rest of the insurance industry, it was greeted with predictions of doom.

“The premium is too low,” one statistician declared. “We admire you for trying, but you’ll lose your shirt.”

“The premium is too high,” warned another expert. “The unions won’t go for it. They’ll hold out for complete coverage or state medicine.”

“You’re vulnerable to every kind of chiseling,” another critic said. “The doctors and the patients can cheat you blind.”

Become a Saturday Evening Post member and enjoy unlimited access. Subscribe now