Did you or someone you know lose a fortune when the economy crashed? And then did you watch in wonder as the banks got bailed out and you didn’t? American bitterness and resentment about banks is not a recent phenomenon. We don’t trust our banks, and, a good part of the time, our bankers have done everything they could to earn that distrust.

It began in the colonial era when we had no conventional banks of our own. Banks were all in England, and England made sure they stayed there. So banks, right from the start, represented the wealth and domination of our foreign overlords. We didn’t even have a single kind of money; people used British and French coins and Spanish dollars, among other things, or just bartered goods. In Virginia, tobacco was used as money. Some colonies issued paper notes redeemable in gold. Not until 1775 did the Continental Congress issue the first all-American paper money used to fight the Revolution. With no gold or silver backing, the currency quickly lost value—thus the expression “not worth a Continental,” which survives even today.

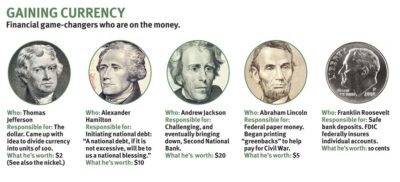

It was Thomas Jefferson who gave birth to the American dollar and came up with the then-novel idea to divide it into an utterly rational 100 cents. Shortly afterward, Alexander Hamilton founded one of the new country’s first banks, the Bank of New York. He was still in his twenties at the time, and five years later he became the first Secretary of the Treasury.

If you disapprove of the national debt, the blame goes back to Hamilton. He argued that the nation needed to be able to take on debt—to issue bonds and to invest in building and growth. National debt also was a tool that allowed the federal government to take over the various states’ crushing war debts. To oversee the flow of money, regulate all the country’s smaller banks, and manage the debt, he founded a national bank (the Bank of the U.S.).

Hamilton’s idea was that only a central bank could impose order on American money and banking. But Jefferson opposed the idea bitterly. He embodied the American horror of banks as manipulative tools of the rich. He once wrote, “My zeal against those institutions was so warm and open at the establishment of the Bank of the U.S. that I was derided as a Maniac by the tribe of bank-mongers, who were seeking to filch from the public their swindling, and barren gains.”

Jefferson was vindicated when almost right away there was a banking scandal. In 1792 people began starting up new banks and selling stock in them; there were rumors that the new national bank would buy at least some of the stocks, and a speculative bubble formed, expanded, and burst. The main speculator, William Duer, wound up in debtor’s prison, and Jefferson estimated that $5 million was lost.

In 1811 the Bank of the U.S.’s charter was allowed to expire, and, with no central authority, the banking business quickly became messier—true to Hamilton’s prediction. There was no national paper money, only banknotes printed by individual banks, and they were typically worth far less than their face value, depending on how much faith people had in the banks behind them. For the entire century, a series of tumultuous events periodically sapped American faith in the banking system. The major disasters included:

• Depression. A deep national economic depression that lasted for years hit in the late 1830s. The problem was caused by a rash of speculation on Western lands paid for with paper money issued by weak banks.

• Crash. Another big banking collapse followed in 1857. The blame is traced to the California Gold Rush, which pumped excessive amounts of money into the economy, leading to a tsunami of reckless borrowing and lending.

• Bad paper. In 1861 President Lincoln started printing the first federal paper money to pay for the Civil War. But without a federal bank behind the money, it lost value just like the old Continentals. In fact, the government itself didn’t accept these “greenbacks” for payment of taxes.

• Bust. Another speculative bubble burst in 1873 leading to still another depression that lasted six years.

• Panic. In 1893 a financial fever broke out that put more than 500 banks out of business, leaving many of their customers broke. The main problem this time was that silver strikes in the West meant there was suddenly a glut of silver. Therefore silver coins became worth less for the value of the raw metal than gold ones despite their equivalent face values. Naturally people started buying the more valuable gold coins with their silver coins, draining the federal Treasury.

Although the country had no federal bank in these years, it did finally get a head of banking, but a completely unofficial, self-appointed one. That was John Pierpont Morgan, by far the most powerful banker of his age. Morgan believed that the most important thing in business was character—an all-too-rare virtue then as now. He once said that “a man I do not trust could not get money from me on all the bonds in Christiandom.”

Morgan stepped in as America’s unofficial head banker to solve the crisis of 1893, finding a way to buy gold in Europe to keep the Treasury from running out of the metal that was the basis of American money. Still, the nation had to endure a depression that lasted for years, and in the 1896 presidential election people who had put their money in silver—largely Western and rural people who hated banks—rallied behind William Jennings Bryan and his famous proclamation that “you shall not crucify mankind upon a cross of gold.”

By 1907 the economy had grown much bigger than all the government’s gold could cover, yet the nation was still on a gold standard. That meant too much borrowing and too much circulating money against too little metal on reserve to guarantee the money’s worth. Another panic hit, and again Morgan had to come to the rescue. He announced that “if people will keep their money in the banks, everything will be all right.” That was entirely true, but saying so wasn’t enough. He singlehandedly called all the nation’s top bankers to his New York City mansion and got them to raise money so cash could keep flowing and to cooperate to keep weaker banks from going under.

This time a depression was averted, but the need for a strong central national bank was finally recognized. It came into existence in 1913 in the form of the Federal Reserve (Read on the Federal Reserve). The Federal Reserve could try to control the health of the economy and banks in general by setting interest rates for its own lending that would set a standard for how much or little borrowing and lending there would be, slowing down the economy when there was too much money and exuberance and speculation and then turning the spigot back on when there was too little. That worked, most of the time, until the Stock Market Crash of 1929 and the Great Depression that followed.

Click on the image to view it full size.

The Crash of 1929 was driven by the widespread belief in an endlessly growing economy. (continued on page 70) There was wildly excessive borrowing and investing in overvalued stocks. When it all came tumbling down, banks failed by the thousands. More than 3,000 of them went under in 1931 alone. Another 1,453 failed in 1932, and thousands more in 1933.

In 1933 Franklin Roosevelt was elected president. He leapt into action, immediately closing all the nation’s banks for several days as he pushed through Congress a bill to give the government unprecedented new powers to regulate the whole system. He also effectively took the nation off the gold standard, allowing the dollar to decline in value so that people’s debts would be worth less—and easier to repay. He made the Federal Reserve much stronger than it had been before. And, most important, he pushed through the Glass-Steagall Act. That law put a federal guarantee behind bank deposits, automatically increasing public confidence in them, and it also made banks choose to be either deposit businesses or investment businesses but not both. Banks could no longer be safe harbor for people’s hard-earned savings and casinos at the same time.

Finally, after more than a century and a half, the U.S. had a truly solid banking system. There had been runs on banks and major waves of bank failures throughout our history; there hasn’t been one since. This country has not been immune to crises, however. In the early 1980s there was the savings and loans (S&Ls) debacle. S&Ls were small local savings banks that dealt mainly in savings accounts and home mortgages instead of checking accounts and business loans. They ran into trouble because they weren’t allowed to raise the interest rates they paid on savings accounts when interest rates everywhere else were rising, so people started withdrawing their money from them. The government responded by letting them raise those rates, but the banks’ home mortgages didn’t make enough money to pay for the high rates. S&Ls went bankrupt en masse, and the federal government had to pay $20 billion in insurance to their depositors.

In the 1990s the federal government for the first time let banks operate across state lines, leading to a long series of mergers and the rise of the nationally operating institutions we’re all familiar with today. Unfortunately, it also—after more than half a century of dependable if unexciting banking—lifted Glass-Steagall’s ban on speculative investment by deposit banks.

That development was one of the causes of the recent Great Recession, as banks discovered they could make the most of the housing boom—which turned into the housing bubble—by gambling on it, bundling ever-more-dubious mortgages, slicing them up, and blending them together to turn them into seemingly fail-safe investments. The banks’ gamble ended not only with millions of Americans bankrupt and homes in foreclosure but also with the huge government bank bailouts of late 2008. It then led to new attempts at stronger regulation again, including the Dodd-Frank Act and its Volcker Rule, which attempts to reinstate some of Glass-Steagall’s prevention of speculative betting by banks. However, many bankers are aghast at the new regulations, especially the Volcker Rule. Jamie Dimon, the head of JPMorgan Chase, recently said of the former Federal Reserve chairman who devised the rule, “Paul Volcker by his own admission has said he doesn’t understand capital markets. He has proven that to me.” The law is unquestionably extremely complex and expensive for banks to implement. Its proponents say it will keep the economy safe; its enemies say it will strangle the economy.

In other words, after centuries of hard experience, we still can’t agree about banking, how powerful banks should be, or how free they should be to do what they want to—or think they must—do. What then have we learned, after more than 200 years of banking disasters? We’ve learned a lot, actually. We’ve gone from a small, new, rural frontier nation of no banks at all to the world’s modern economic behemoth with banks and banking power to match. We’ve grown very painfully at times, but we’ve grown in ways no one ever could have begun to imagine. And we at least were able to keep the Great Recession from becoming another Great Depression. Unemployment reached 10 percent in 2009, but it hit 24.9 percent in 1932—and didn’t fully recover until World War II.

In the end there may, sadly, be a limit to what we can learn and how much we can control about banking. The people who run banks are only human. They see the world imperfectly, as we all do, yet they must make decisions of great consequence based on what they see. Only a national bank can try to control the sum of what all the nation’s bankers do, but that is almost like controlling the weather. An economy is the total of everybody’s activities everywhere, so it is as complicated as all the wind and rain and sunshine in the world combined. And even if bankers were superhuman and we could truly dominate something as complex as weather or an economy, there would still be that vexing choice between risk and opportunity. We all want a higher return on our investments, but that means taking a greater risk that we’ll lose it all. We all want to borrow at lower rates, but that means less money going into banks to create those higher returns we want. We all want to take chances, but we don’t want to be hurt if those chances go wrong.

Our whole economic system, like our political system, is but a reflection of the imperfectability of human nature. And that is why capitalism is, as Winston Churchill once said of democracy, the worst possible way of doing things—except for all the other ways that have ever been tried.

BANKS: A Love Hate Story

Click on the image to view it full size.

We can’t live without banks, but that doesn’t mean we have to admire them. Banking excesses and the attempts to curb them have shaped our economy since the founding of the republic.

In recent years we’ve seen the bailout of some of our largest banks—with the resulting hue and cry of such diverse groups as Occupy Wall Street and the Tea Party. Most banks have since paid off their loans, but critics warn that a “too big to fail” mentality will ultimately harm the nation.

Will a few big players—the top five banks today control more than half of all U.S. assets—now be encouraged to engage in even riskier behavior, knowing the government will step in to catch them if they fall? Have we undermined the free enterprise system—not to mention the American sense of fair play—by sending the signal that the system supports the strong and abandons the weak?

Finally, did the bailout even work? Four years later the financial markets are in better shape, but unemployment continues to be unacceptably high, state and local governments are starved for cash, and housing has not yet recovered.

Some experts also ask whether it is even possible to manage domestic finance in a global economy: Today, more than ever, the collapse of a foreign country would have disastrous ripple effects on our shores.

Love it or hate it, the bailout is best understood in the context of the historical tug of war between those who support federal banking authority and those who oppose it. The latter group warns of the excess power and potential for corruption in a central bank; those favoring a centralized bank believe a united authority is essential for managing the money supply and the national debt. Key dates in banking history are at right.

Read Jekyll Island and the Secret Behind the Fed for more history from the Post.

Become a Saturday Evening Post member and enjoy unlimited access. Subscribe now