The Botched Hospital Bill

This article was reported and written in collaboration between NPR and ProPublica, the nonprofit investigative journalism organization.

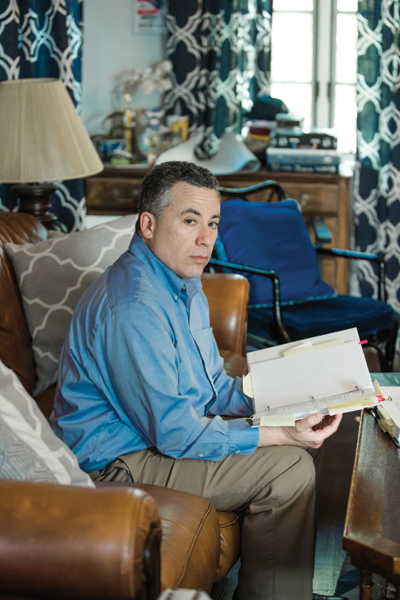

Michael Frank ran his finger down his medical bill, studying the charges, and pausing in disbelief. The numbers didn’t make sense.

His recovery from a partial hip replacement had been difficult. He had iced and elevated his leg for weeks. He had pushed his 49-year-old body, limping and wincing, through more than a dozen physical therapy sessions.

The last thing he needed was a botched bill.

His December 2015 surgery to replace the ball in his left hip joint at NYU Langone Health in New York City had been routine. One night in the hospital and no complications.

He was even supposed to get a deal on the cost. His insurance company, Aetna, had negotiated an in-network “member rate” for him. That is the discounted price insured patients get in return for paying their premiums every month.

But Frank was startled to see that Aetna had agreed to pay NYU Langone $70,000. That’s more than three times the Medicare rate for the surgery and more than double the estimate of what other insurance companies would pay for such a procedure, according to a nonprofit that tracks prices.

Fuming, Frank reached for the phone. He couldn’t see how NYU Langone could justify these fees. And what was Aetna doing? As his insurer, wasn’t its duty to represent him, its “member”? So why had it agreed to pay a grossly inflated rate, one that stuck him with a $7,088 bill for his portion?

Frank wouldn’t be the first to wonder. The United States spends more per person on healthcare than any other country does. A lot more. As a country, by many measures, we are not getting our money’s worth. Tens of millions remain uninsured. And millions are in financial peril: About 1 in 5 is currently being pursued by a collection agency over medical debt. Healthcare costs repeatedly top the list of consumers’ financial concerns.

Experts frequently blame this on the high prices charged by doctors and hospitals. But less scrutinized is the role insurance companies — the middlemen between patients and those providers — play in boosting our healthcare tab. Widely perceived as fierce guardians of healthcare dollars, insurers, in many cases, aren’t. In fact, they often agree to pay high prices, then, one way or another, pass those high prices on to patients — all while raking in healthy profits.

ProPublica and NPR are examining the bewildering, sometimes enraging ways the health insurance industry works by taking an inside look at the games, deals, and incentives that often result in higher costs, delays in care, or denials of treatment. The misunderstood relationship between insurers and hospitals is a good place to start.

About half of Americans get their healthcare benefits through their employers, who rely on insurance companies to manage the plans, restrain costs, and get them fair deals.

But as Frank eventually discovered, once he had signed on for surgery, a secretive system of precut deals came into play that had little to do with charging him a reasonable fee.

After Aetna approved the in-network payment of $70,882 (not including the fees of the surgeon and anesthesiologist), Frank’s coinsurance required him to pay the hospital 10 percent of the total.

When Frank called NYU Langone to question the charges, the hospital punted him to Aetna, which told him it paid the bill according to its negotiated rates. Neither Aetna nor the hospital would answer his questions about the charges.

Frank found himself in a standoff familiar to many patients. The hospital and insurance company had agreed on a price, and he was required to help pay it. It’s a three-party transaction in which only two of the parties know how the totals are tallied.

Frank could have paid the bill and gotten on with his life. But he was outraged by what his insurance company agreed to pay. “As bad as NYU is,” Frank said, “Aetna is equally culpable because Aetna’s job was to be the checks and balances and to be my advocate.”

And he also knew that Aetna and NYU Langone hadn’t double-teamed an ordinary patient. In fact, if you imagined the perfect person to take on insurance companies and hospitals, it might be Frank.

For three decades, Frank has worked for insurance companies like Aetna, helping to assess how much people should pay in monthly premiums. He is a former president of the Actuarial Society of Greater New York and has taught actuarial science at Columbia University. He teaches courses for insurance regulators and has even served as an expert witness for insurance companies.

The hospital and insurance company may have expected him to shut up and pay. But Frank wasn’t going away.

Patients fund the entire healthcare industry through taxes, insurance premiums, and cash payments. Even the portion paid by employers comes out of an employee’s compensation. Yet when the healthcare industry refers to “payers,” it means insurance companies or government programs like Medicare.

Patients who want to know what they’ll be paying — let alone shop around for the best deal — usually don’t have a chance. Before Frank’s hip operation, he asked NYU Langone for an estimate. It told him to call Aetna, which referred him back to the hospital. He never did get a price.

Imagine if other industries treated customers this way. The price of a flight from New York to Los Angeles would be a mystery until after the trip. Or, while digesting a burger, you could learn it cost 50 bucks.

A decade ago, the opacity of prices was perhaps less pressing because medical expenses were more manageable. But now patients pay more and more for monthly premiums, and then, when they use services, they pay higher co-pays, deductibles, and coinsurance rates.

Employers are equally captive to the rising prices. They fund benefits for more than 150 million Americans and see healthcare expenses eating up more and more of their budgets.

Richard Master, the founder and CEO of MCS Industries in Easton, Pennsylvania, offered to share his numbers. By most measures, MCS is doing well. Its picture frames and decorative mirrors are sold at Walmart, Target, and other stores and, Master said, the company brings in more than $200 million a year.

But the cost of healthcare is a growing burden for MCS and its 170 employees. A decade ago, Master said, an MCS family policy cost $1,000 a month with no deductible. Now it’s more than $2,000 a month with a $6,000 deductible. MCS covers 75 percent of the premium and the entire deductible. Those rising costs eat into every employee’s take-home pay.

Economist Priyanka Anand of George Mason University said employers nationwide are passing rising healthcare costs on to their workers by asking them to absorb a larger share of higher premiums. Anand studied Bureau of Labor Statistics data and found that every time healthcare costs rose by a dollar, an employee’s overall compensation got cut by 52 cents.

Master said his company hops between insurance providers every few years to find the best benefits at the lowest cost. But he still can’t get a breakdown to understand what he is actually paying for.

“You pay for everything, but you can’t see what you pay for,” he said.

Master is a CEO. If he can’t get answers from the insurance industry, what chance did Frank have?

Frank’s hospital bill and Aetna’s “explanation of benefits” arrived at his home in Port Chester, New York, about a month after his operation. Loaded with an off-putting array of jargon and numbers, the documents were a natural playing field for an actuary like Frank.

As Frank eventually discovered, once he had signed on for surgery, a secretive system of precut deals came into play that had little to do with charging him a reasonable fee.

Under the words DETAIL BILL, Frank saw that NYU Langone’s total charges were more than $117,000, but that was the sticker price, and those are notoriously inflated. Insurance companies negotiate an in-network rate for their members. But in Frank’s case at least, the “deal” still cost $70,882.

With a practiced eye, Frank scanned the billing codes hospitals use to get paid and immediately saw red flags: There were charges for physical therapy sessions that never took place and drugs he never received.

One line stood out — the cost of the implant and related supplies. Aetna said NYU Langone paid a “member rate” of $26,068 for “supply/implants.” But Frank didn’t see how that could be accurate. He called and emailed Smith & Nephew, the maker of his implant, until a representative told him the hospital would have paid about $1,500. His NYU Langone surgeon confirmed the amount, Frank said. The device company and surgeon did not respond to requests for comment.

Frank then called and wrote Aetna multiple times, sure it would want to know about the problems. “I believe that I am a victim of excessive billing,” he wrote. He asked Aetna for copies of what NYU Langone submitted so he could review it for accuracy, stressing he wanted “to understand all costs.”

Aetna reviewed the charges and payments twice — both times standing by its decision to pay the bills. The payment was appropriate based on the details of the insurance plan, Aetna wrote.

Frank also repeatedly called and wrote NYU Langone to contest the bill. In its written reply, the hospital didn’t explain the charges. It simply noted that they “are consistent with the hospital’s pricing methodology.”

Increasingly frustrated, Frank drew on his decades of experience to essentially serve as an expert witness on his own case. He gathered every piece of relevant information to understand what happened, documenting what Medicare, the government’s insurance program for the disabled and people over age 65, would have paid for a partial hip replacement at NYU Langone — about $20,491 — and what FAIR Health, a New York nonprofit that publishes pricing benchmarks, estimated as the in-network price of the entire surgery, including the surgeon fees — $29,162.

He guesses he spent about 300 hours meticulously detailing his battle plan in 2-inch-thick binders with bills, medical records, and correspondence.

ProPublica sent the Medicare and FAIR Health estimates to Aetna and asked why it had paid so much more. The insurance company declined an interview and said in an emailed statement that it works with hospitals, including NYU Langone, to negotiate the “best rates” for members. The charges for Frank’s procedure were correct given his coverage, the billed services, and the Aetna contract with NYU Langone, the insurer wrote.

NYU Langone also declined ProPublica’s interview request. The hospital said in an emailed statement that it billed Frank according to the contract Aetna had negotiated on his behalf. Aetna, it wrote, confirmed the bills were correct.

After seven months, NYU Langone turned Frank’s $7,088 bill over to a debt collector, putting his credit rating at risk. “They upped the ante,” he said.

Frank sent a new flurry of letters to Aetna and to the debt collector and complained to the New York State Department of Financial Services, the insurance regulator, and the New York State Office of the Attorney General. He even posted his story on LinkedIn.

But no one came to the rescue. A year after he got the first bills, NYU Langone sued him for the unpaid sum. He would have to argue his case before a judge.

You would think that health insurers would make money, in part, by reducing how much they spend.

Turns out, insurers don’t have to decrease spending to make money. They just have to accurately predict how much the people they insure will cost. That way they can set premiums to cover those costs — adding about 20 percent for their administration and profit. If they’re right, they make money. If they’re wrong, they lose money. But, they aren’t too worried if they guess wrong. They can usually cover losses by raising rates the following year.

Frank suspects he got dinged for costing Aetna too much with his surgery. The company raised the rates on his small group policy — the plan just includes him and his partner — by 18.75 percent the following year.

The Affordable Care Act kept profit margins in check by requiring companies to use at least 80 percent of the premiums for medical care. That’s good in theory, but it actually contributes to rising healthcare costs. If the insurance company has accurately built high costs into the premium, it can make more money. Here’s how: Let’s say administrative expenses eat up about 17 percent of each premium dollar and around 3 percent is profit. Making a 3 percent profit is better if the company spends more.

It’s as if a mom told her son he could have 3 percent of a bowl of ice cream. A clever child would say, “Make it a bigger bowl.”

Wonks call this a “perverse incentive.”

“These insurers and providers have a symbiotic relationship,” said Wendell Potter, who left a career as a public relations executive in the insurance industry to become an author and patient advocate. “There’s not a great deal of incentive on the part of any players to bring the costs down.”

Insurance companies may also accept high prices because often they aren’t always the ones footing the bill. Nowadays about 60 percent of the employer benefits are “self-funded.” That means the employer pays the bills. The insurers simply manage the benefits, processing claims and giving employers access to their provider networks. These management deals are often a large, and lucrative, part of a company’s business. Aetna, for example, insured 8 million people in 2017, but provided administrative services only to considerably more — 14 million.

To woo the self-funded plans, insurers need a strong network of medical providers. A brand-name system like NYU Langone can demand — and get — the highest payments, said Manuel Jimenez, a longtime negotiator for insurers, including Aetna. “They tend to be very aggressive in their negotiations.”

On the flip side, insurers can dictate the terms to the smaller hospitals, Jimenez said. The little guys “get the short end of the stick,” he said. That’s why they often merge with the bigger hospital chains, he said, so they can also increase their rates.

Other types of horse-trading can also come into play, experts say. Insurance companies may agree to pay higher prices for some services in exchange for lower rates on others.

Patients, of course, don’t know how the behind-the-scenes haggling affects what they pay. By keeping costs and deals secret, hospitals and insurers dodge questions about their profits, said Dr. John Freedman, a Massachusetts healthcare consultant. Cases like Frank’s “happen every day in every town across America. Only a few of them come up for scrutiny.”

In response, a Tennessee company is trying to expose the prices and steer patients to the best deals. Healthcare Bluebook aims to save money for both employers who self-pay and their workers. Bluebook used payment information from self-funded employers to build a searchable online pricing database that shows the low-, medium-, and high-priced facilities for certain common procedures, like MRIs. The company, which launched in 2008, now has more than 4,500 companies paying for its services. Patients can get a $50 bonus for choosing the best deal.

Bluebook doesn’t have price information for Frank’s operation: a partial hip replacement. But its price range in the New York City area for a full hip replacement is from $28,000 to $77,000, including doctors’ fees. Its “fair price” for these services tops out at about two-thirds of what Aetna agreed to pay on Frank’s behalf.

Frank, who worked with mainstream insurers, didn’t know about Bluebook. If he had used its data, he would have seen that there were facilities that were both high quality and offered a fair price near his home, including Holy Name Medical Center in Teaneck, New Jersey, and Greenwich Hospital in Connecticut. NYU Langone is one of Bluebook’s highest-priced high-quality hospitals in the area for hip replacements. Others on Bluebook’s pricey list include Montefiore New Rochelle Hospital in New Rochelle, New York, and Hospital for Special Surgery in Manhattan.

ProPublica contacted Hospital for Special Surgery to see whether it would provide a price for a partial hip replacement for a patient with an Aetna small-group plan like Frank’s. The hospital declined, citing its confidentiality agreements with insurance companies.

Frank arrived at the Manhattan courthouse on April 2, 2018, wearing a suit and fidgeted in his seat while he waited for his hearing to begin. He had never been sued for anything, he said. He and his attorney, Gabriel Nugent, made quiet conversation while they waited for the judge.

In the back of the courtroom, NYU Langone’s attorney, Anton Mikofsky, agreed to talk about the lawsuit. The case is simple, he said. “The guy doesn’t understand how to read a bill.”

The high price of the operation made sense because NYU Langone has to pay its staff, Mikofsky said. It also must battle with insurance companies that are trying to keep costs down, he said. “Hospitals all over the country are struggling,” he said.

“Aetna reviewed it twice,” Mikofsky added. “Didn’t the operation go well? He should feel blessed.”

When the hearing started, the judge gave each side about a minute to make its case, then pushed them to settle.

Mikofsky told the judge Aetna found nothing wrong with the billing and had already taken care of most of the charges. The hospital’s position was clear. Frank owed $7,088.

Nugent argued that the charges had not been justified and Frank felt he owed about $1,500.

The lawyers eventually agreed that Frank would pay $4,000 to settle the case.

Frank said later that he felt compelled to settle because going to trial and losing carried too many risks. He could have been hit with legal fees and interest. It would have also hurt his credit at a time he needs to take out college loans for his kids.

After the hearing, Nugent said a technicality might have doomed their case. New York defendants routinely lose in court if they have not contested a bill in writing within 30 days, he said. Frank had contested the bill over the phone with NYU Langone and in writing within 30 days with Aetna. But he did not dispute it in writing to the hospital within 30 days.

Frank paid the $4,000 but held on to his outrage. “The system,” he said, “is stacked against the consumer.”

This story was originally published by ProPublica.

This article is featured in the March/April 2019 issue of The Saturday Evening Post. Subscribe to the magazine for more art, inspiring stories, fiction, humor, and features from our archives.

Featured image credit: Shutterstock