Steve Weisman is a lawyer, college professor, author, and one of the country’s leading experts in cybersecurity, identity theft, and scams. See Steve’s other Con Watch articles.

In response to last year’s massive data breach at Equifax, one of the three major credit reporting agencies, Congress recently passed the Economic Growth, Regulatory Relief and Consumer Protection Act, which among other provisions will permit consumers to freeze and unfreeze their credit reports for free.

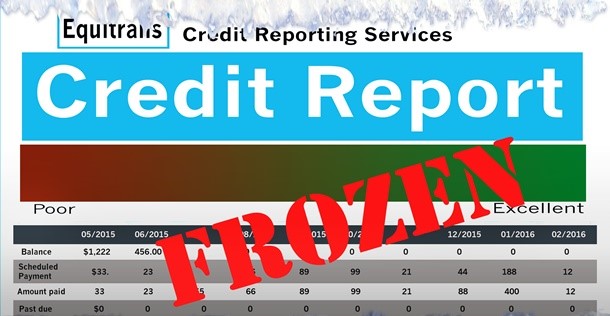

The very best thing you can do to protect yourself from many forms of identity theft is to put a freeze on your credit report at each of the three major credit reporting agencies: Equifax, Experian and TransUnion. A credit freeze prevents anyone from having access to your credit report, which makes it much more difficult for an identity thief, even one armed with your Social Security number, from getting loans, purchasing items, or opening lines of credit in your name.

While many Americans froze their credit reports in the wake of the data breach, a recent study by Consumer Reports indicates that 52 percent of people aware of the Equifax data breach have not frozen their reports, and an AARP survey shows only about 14 percent of people have security freezes.

Many people may have refrained from getting freezes because of the costs involved. While the costs vary from state to state, they are generally between $5 and $15 each time you freeze or unfreeze your report. (Unfreezing your credit report is necessary whenever you apply for credit, rent an apartment, apply for a loan or do any other business transaction where there is a necessary and legitimate purpose for your credit report to be reviewed.)

Because of the new law, however, freezing and unfreezing your report will be free. The actual process is actually quite simple. It can be done over the phone or online and usually takes only about fifteen minutes. Additionally, if you need to unfreeze your credit, you can automatically set a time frame to “re-freeze” your report, giving time enough for the company with which you are doing business to review your report.

The Economic Growth, Regulatory Relief and Consumer Protection Act is also the first national law to protect children from identity theft. Under the new law, parents will be able to establish and freeze credit reports for their minor children. Child identity theft has become a major problem, and until now only 29 states permitted the establishing and freezing of credit reports for children.

Once the law goes into effect on September 21, Equifax, Experian and TransUnion must set up webpages for consumers to request credit freezes. The Federal Trade Commission (FTC) will post links to those webpages at identitytheft.gov.

Another provision of the new law requires the agencies to provide free credit monitoring to all members of the active military.

Unfortunately, the new law has left a loophole. The National Consumer Telecommunications and Utilities Exchange (NCTUE), which is the credit reporting agency used by the major phone service companies, is not subject to the new law. Scammers can still open cell phone accounts in the name of an unwary victim who may have actually frozen their credit with the three credit reporting agencies, but not with NCTUE. For information about freezing your report with NCTUE, visit nctue.com/consumers.

Become a Saturday Evening Post member and enjoy unlimited access. Subscribe now