Taxes remain one of the great contradictions of society. No one likes to pay them, but basic things like roads, police and fire departments, public schools, public parks, and thousands of other necessities wouldn’t exist without them. We spend a lot of time dreading the filing and paying of taxes, and seemingly more time waiting on any refund we might have gotten. However, we spend precious little time thinking about the basic facts of taxes. Why is Tax Day April 15? Does filing have to be complicated? How much of my taxes go to which programs? Today, we take a quick look at four of the more taxing questions.

1. Why is Tax Day on April 15?

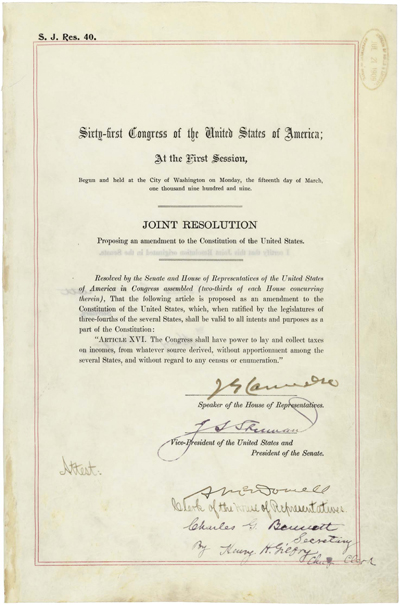

Tax Day has been fixed on or around April 15 since 1955. Income tax has been a constant since the Revenue Act of 1861, which went into effect to levy monies from income to help pay for the Union’s war expenses. If you made more than $800, you had to pay a three percent flat tax. That was repealed in 1871, but a new flat federal income tax law went into effect in 1894. The Supreme Court threw that one out, based on a claim that taxes needed to be tied into population distribution. The population question was eliminated by the 16th Amendment, which was passed in 1909 and ratified in 1913; the amendment allowed for an individual income tax regardless of population.

In 1913, the filing deadline was March 1. That was pushed to March 15 in 1918. During tax code reforms in the mid-1950s, the date got pushed again, this time to April 15. The basic reason is that, well, it takes a lot of time to do all the paperwork. Knowing that there’s a deadline down the road, it theoretically gives people all of January, February, March, and half of April to do their filing for the previous year. However, very few people do it as soon as the calendar turns (“As soon as I kick this New Year’s hangover, I’ll file my returns” is not a common sentiment).

2. When Did Electronic Filing Begin?

You might think of e-filing as a relatively recent innovation, but it’s actually been available since 1986. That’s right; 33 years ago, five tax preparers agreed to take part in the first e-file program. It waspretty complicated; the preparers used a Mitron, which was a machine that was basically a tape reader connected to a modem. The tape with the tax data would go into the Mitron; the data would then transfer via the modem to a different machine at the IRS called a Zilog. The Zilog read and reconfigured the data for the Unisys computer that the IRS had at the time. Like we said: complicated.

By 1987, the IRS began to allow electronic direct deposits so you could get your refund as soon as possible. The next year, they shed the complicated Zilog system in favor of IBM Series I. With the continuing evolution of electronic communications and the internet, half of all returns were e-filed by 2005. The IRS stopped mailing out 1040s in 2010, making them and other forms available online.

3. Isn’t This All Simpler in Other Countries?

In a word, yes. A number of countries have what we call “return-free” taxes. That is, the equivalent of the IRS does your taxes for you ahead of time, sends you a verification form to make sure everything is correct, gives you time to make sure it’s right, and then you send it back. That’s how it works in Spain, Denmark, and Sweden. Japan and the U.K. use “precision withholding,” which are regular withdrawals that take care of what you owe while accounting for your charitable contributions.

While some complications stem from the fact that our tax system tries to be fair and observe that differences in income can affect how people are taxed, that’s only part of the issue. In the U.S., efforts to make your filing easier, and even free, have been undermined by lobbying. Intuit, the makers of TurboTax, has spent $20 million in lobbying in the past 10 years to keep things the way they are. Confusing legislation exists right now that would ban the IRS from making their own free tax-filing software available, keeping private companies like Intuit and H&R Block in control. The legislation would require the companies to make free software available to everyone that makes under $66,000 a year, but that could be a problem for people who file jointly, depending on the specificity of the rules. It’s safe the say that filing won’t get much easier anytime soon.

4. Where Exactly Does Our Tax Money Go?

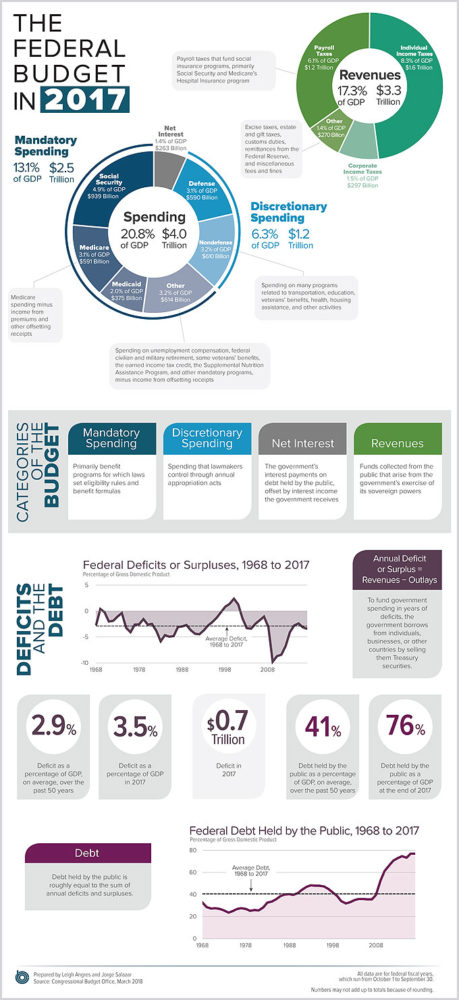

This is a perennial question, but it got a lot more attention recently when rapper Cardi B asked about it on her Instagram in March. A number of outlets, like CNBC, rushed to provide answers and statistics. Citing the Peterson Foundation, the article indicated that about half of our discretionary spending (the spending that lawmakers control with appropriations) from tax revenue goes into defense, which was roughly $6.11 billion in 2017. For context, the Foundation notes thatU.S. defense spending is “more than China, Saudi Arabia, Russia, United Kingdom, India, France and Japan [defense spending] combined.” In other discretionary funds, six percent goes into education, with another six going into Medicare and related accounts. When we examine what is spent on “mandatory spending,” which are programs that have been set by laws, that goes to things like science, agriculture, transportation, social security, health care, and anti-poverty accounts like SNAP.

Like them or not, taxes, simply put, are how we pay for things in America. Different countries may have different priorities and programs, but they typically push toward the same rough equivalent, which is an overall attempt to provide services and security to citizens. Whether we pay in March or April, whether we file on paper or on a computer, taxes always come due.

Featured image: Shutterstock

Become a Saturday Evening Post member and enjoy unlimited access. Subscribe now