How the Great Recession Forced Us to Political Extremes

The effects of what would later be termed the Great Recession reverberated for years, even as the U.S. began to climb out of it in the second half of 2009. An unexpected side effect grew out of the economic morass, and that was the birth or revitalization of social movements on both ends of the political spectrum. These activist groups would soon come to exert an oversized influence on elections, social policy, and the country at large.

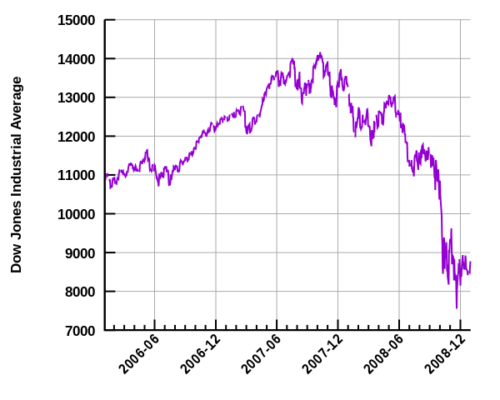

In the universe of the average American worker — far removed from the madness and greed of the short sellers, the risky credit default swaps of the big banks, and the

monstrous greed of Wall Street in general — the Great Recession was devastating. People lost homes, jobs, everything they’d spent a lifetime working toward. Unemployment rose rapidly: from November 2008 to October 2009, unemployment shot from 6.8 percent to 10 percent. Scholars have noted the subsequent rise in economic activism in the United States. Both the Tea Party movement and the Occupy movement have roots in the soil of the economic crisis. The Tea Party movement found its rallying point in the actions taken by the recently inaugurated President Barack Obama to address the Recession in 2009. Obama’s Homeowner Affordability and Stability Plan, an effort to directly help the homeowners most impacted by the subprime crisis, triggered “big government” resentment that fueled the movement. At the other end of the political spectrum, Occupy sought to address social and economic inequality with protests directed at a financial system that they felt had victimized vulnerable Americans.

Journalist Sarah Jaffe, author of Necessary Trouble: Americans in Revolt, points out that these movements represent the aftermath of the collapse and recession for young Americans. She says, “When you look at young people, you see the effects that it has had. The rise of socialism, of Bernie Sanders in the U.S. and Jeremy Corbyn in the U.K. and Jean-Luc Mélenchon in France, show us that people have now begun to imagine a different world, a world that has very different priorities.”

“The belief by Main Street is that the bankers got away with it, and Main Street paid the bill.”

Robert Johnson, professor of finance from the Heider College of Business at Creighton University, agrees. “While many look at the influence of the financial crisis on the financial sector and the economy, the longest-lasting impact is in the political and social spheres,” he says. “It has divided both this nation and the world and has increased political rancor and further widened the chasm between the right and left — nearly vacating the middle.” Johnson believes that many of the populist movements that have sprung up in America, Europe, and the Middle East came as a “direct result of the financial crisis and its aftermath.”

For its part, the Tea Party movement wasn’t all new. Citizens for a Sound Economy (CSE) was founded in 1984 by Koch Industries heads, brothers David H. and Charles G. Koch; CSE was a conservative political group focusing on lower taxes, fewer regulations, and smaller government. In 2002, CSE launched a (now defunct) website at usteaparty.com that professed opposition to high taxes and what they viewed as an overly complicated tax code. By 2004, CSE had broken into two groups: FreedomWorks and the Americans for Prosperity Foundation.

As the Great Recession continued into 2009, President Obama announced the Homeowner Affordability and Stability Plan; it was funded by the Housing and Economic Recovery Act of 2008 that was signed by President George W. Bush that July. The Obama plan, which would help Americans struggling from the effects of the subprime mortgage crisis, was not greeted warmly in many conservative circles. It catalyzed what some felt was government overreach and overspending. In 2009, individual Tea Party events coalesced into a much broader movement. One might be surprised that a government program to rescue struggling homeowners would be perceived as a negative, but as Johnson says, the Recession “led to lost trust and faith in both governments and experts to craft a path forward.”

At the other end of the political spectrum, the Occupy movement took its ire out on the financial system. The Occupy protests kicked off on September 17, 2011, when 1,000 people marched on Wall Street, targeting income inequality and the actions of lenders that led to the Great Recession. Regarding Occupy, Johnson notes, “It can be rightly argued that many of the principals at financial institutions responsible for excessive risk-taking did not bear the consequences of their actions. The belief by Main Street is that the bankers got away with it, and Main Street paid the bill.”

Occupy, itself partially inspired by the Arab Spring and anti-austerity protests around the world, kicked off new protests throughout the U.S. and other countries. The movement was galvanized by scenes of police brutality, including nonviolent protestors being pepper-sprayed on September 24, 2011. More protests occurred in major American cities, with thousands taking part. While the initial thrust had worn off by December, activists spread out and integrated into other groups, addressing income inequality, healthcare, and other concerns.

The Tea Party and the Occupy movement may be opposite ends of the spectrum, but they’re an interesting bellwether for the situation the country found itself in at the 2016 election, and now. Johnson says, “The greatest fallout from the financial crisis is not lost wealth but is a further divided electorate with radically different ideas on the best future course of action.”

What does that mean for America? Common ground may be increasingly hard to find. As Johnson says, “Each side’s view is reinforced by the echo chamber that is cable news.”

It may be melodramatic to say that the crisis that broke the economy broke the country, but the case can certainly be made that the long recovery still has a long way to go.

This article is featured in the January/February 2019 issue of The Saturday Evening Post. Subscribe to the magazine for more art, inspiring stories, fiction, humor, and features from our archives.

The Company that Nearly Bankrupted America

Science teaches us that whatever goes up must come down. Myths teach us that Titans fall. And history is full of warnings, indicators that can predict future success or failure based on the patterns of previous behavior. Sometimes, all of those lessons can be applied to a situation, particularly one that’s dire enough to be studied, and learned from, and potentially avoided in the future. That’s the case with Lehman Brothers. Before 2008, it was the fourth-largest investment bank in the United States and had been in business for more than 150 years. In September 2008, the company would declare bankruptcy with the largest filing in U.S. history, shaking the world economy and unveiling a tangled web of toxic assets, bad decisions, and litigation. What happened?

To understand how deeply woven Lehman had become in the financial fabric of America, you have to look at its origins. Lehman started as a dry-goods store in 1844. Founded by Bavarian immigrant Henry Lehman, and joined later by his two brothers Emanuel and Mayer, the company soon got involved in commodities trading when it began accepting raw cotton as payment at the store. The brothers started a second business focused only on trading, and it quickly outpaced the store. Henry died of yellow fever in 1855, but the brothers kept the commodities business going. Following the cotton trade as it shifted the center of its orbit to New York City, the brothers opened an office there in 1858.

As that business grew, it took on other markets, like coffee, and expanded into railroad bonds. The company was key in financing the reconstruction of Alabama after the Civil War. In 1889, it underwrote its first public offering. In the 1920s and ’30s, the firm underwrote dozens of further issues, including those for F.W. Woolworth, R.H. Macy & Company, B.F. Goodrich, The Studebaker Corporation, and many more. In a sense, Lehman became big simply by being big and thinking big; it enabled the launch of titans of industry and brands that became household names.

By the financially turbulent 1970s, Lehman had embarked on a series of mergers and acquisitions to stay alive. It acquired Abraham & Company in 1975, then merged with Kuhn, Loeb & Company in 1977. The newly rechristened Lehman Brothers, Kuhn, Loeb Inc. became the fourth-largest investment bank in the U.S. Shearson/American Express bought the company for $360 million in 1984; it in turn merged with E.F. Hutton & Company in 1988. All of this consolidation guaranteed that the renamed Shearson Lehman Hutton would remain a strong institution, but it was also emblematic of the enormous financial power being concentrated into the hands of fewer firms. In 1994, American Express spun out Lehman Brothers Holding, Inc. in an IPO. Chairman and CEO Richard Fuld Jr. would be its final leader.

In 1997, Lehman made moves into mortgage origination. It bought BNC Mortgage, a subprime lender, in 2004 to join earlier acquisition Aurora Loan Services. Subprime lending, in theory, allowed people with less substantial credit to secure loans to buy a home. By 2003, Lehman ranked third in such loans. By 2006, BNC and Aurora were lending an astonishing $50 billion a month. By 2008, Lehman’s assets were valued at $680 billion; however, it only had $22.5 billion in firm capital. These were dangerous waters, as market fluctuations could put their entire structure in jeopardy.

Things began to take a negative turn in 2007 as the subprime mortgage crisis began in earnest. Lehman closed BNC, a move that cut 1,200 jobs. At the news of BNC’s closure, Lehman’s stock initially fell only 34 cents. By mid-2008, the company was in much deeper trouble. As reported in The New York Times on August 22, 2008, Lehman’s loss by the second fiscal quarter was $2.8 billion. “What happened was that home delinquencies in the subprime market rose dramatically and spread to the rest of the U.S. housing market,” says Robert Johnson, professor of finance from the Heider College of Business at Creighton University. “The mortgage-backed securities Lehman held in its portfolio fell dramatically in value, and the firm became insolvent and was forced to declare bankruptcy when no willing suitors could be identified.”

Lehman stock dropped 45 percent on September 9 when a proposed takeover by a Korean bank fell through. On September 10, Lehman announced a loss of $3.9 billion; stock dropped 7 percent as it announced further cutbacks in services. One day later, the stock dropped another 42 percent.

In 1997, Lehman made moves in mortgage origination. By 2006, [its subsidiaries] were lending an astonishing $50 billion a month.

Other forces came into play. Bank of America and Barclay’s emerged as potential buyers, but both passed. By September 15, what had once seemed impossible became inevitable. Lehman Brothers filed for Chapter 11 bankruptcy.

The collapse shook the world economy and led to the U.S. government intervening in the form of the Emergency Economic Stabilization Act of 2008, which created the Troubled Asset Relief Program (TARP) that allocated $700 billion (capped at $475 billion in 2010 by the Dodd-Frank Act) to buy toxic assets and bolster the financial system.

If we have learned anything, it’s that failures of big banks ripple across the world and cause the greatest damage to ordinary citizens who lose jobs, homes, and security.

How much at risk are we of another recession today, just over 10 years removed from the nadir of the Great Recession? Financial observers are wary. Yes, the Dow hit some highs this fall, but a precipitous drop just before Thanksgiving wiped out the year’s gains. Some experts also point to the fact that today’s long-term bond rates have dipped almost as low as short-term bond rates — a warning sign of an impending economic downturn.

As the saying goes, “History doesn’t repeat itself, but it often rhymes.”

This article is featured in the January/February 2019 issue of The Saturday Evening Post. Subscribe to the magazine for more art, inspiring stories, fiction, humor, and features from our archives.