Cartoons: Funny Money

Want even more laughs? Subscribe to the magazine for cartoons, art, inspiring stories, fiction, humor, and features from our archives.

Brad Anderson

July 3, 1954

Mort Temes

May 15, 1954

Bill King

April 24, 1954

Al Johns

April 17, 1954

David Pascal

April 17, 1954

Stan Fine

April 10, 1954

Ken Duggan

April 9, 1955

Bill Mittlebeeler

December 5, 1953

Want even more laughs? Subscribe to the magazine for cartoons, art, inspiring stories, fiction, humor, and features from our archives.

Invest in Yourself

In 1930s, humorist J.P. McEvoy wrote the Post column “Father Meets Son” presented to readers in the form of letters filled with advice for navigating life’s rocky road. Employing a mix of wry humor and tough love, Dad doled out life lessons on everything from work to women. Readers loved it.

Now that his son has some money coming in, Dad offers his financial advice: Ignore the recommendations of bankers, the government, and businessmen to save your money. Spend it instead. Spending wisely is more difficult than saving wisely, but its rewards are much greater.

Father Meets Son: Invest in Yourself

J.P. McEvoy

Originally published on February 13, 1937

Dear Son: Now that you have started to earn a little money, you are going to be swamped with advice on how to spend it. I hope you won’t mind if I put in my two cents’ worth. I feel unusually qualified to discuss thrift, since I have seldom practiced it. Some people make money by saving it. Others make money by spending it. Fundamentally, this is a matter of temperament. Some people can give till it hurts. Others you have to hurt before they’ll give.

For good or bad, you have inherited or acquired some of my idiosyncrasies. Your complete lack of interest in saving money is one of them. In one way, this distresses me. In another way, it gives me great hopes for you. It distresses me because you are going to run into a lot of trouble that easily could be avoided. It pleases me because too often boys who start out loving money a little grow up to be men who love it too much.

You are going to hear a lot about saving money for a rainy day and investing it for your old age. It may sound like heresy to you, but I don’t believe very much in it. People who worry too much about rainy days can’t enjoy the sunny ones, and people who spend their youth worrying about their old age, wind up spending their old age regretting their youth.

But one should save, you say. Very true. You should save because it is good discipline. You should save in order to acquire a surplus. But what should you do with your surplus? Bankers will tell you to put it in a savings account, where you’ll get 2 percent for it. Businessmen will tell you to put it into a business, where you will get 5 percent with safety and 10 percent with luck. The government will tell you to put it in government bonds. Who am I, to go against all these people?

Not so long ago, I was talking to a friend who is an international authority on finance. I said to him: “Suppose I had $25,0000 to give you to invest for me, and all I wanted to be sure of was that I would get the principal back in 25 years — just my $25,0000, never mind the interest. What would you put it in?” He thought it over for a long time, and then said: “I’ll be honest with you. I don’t know.”

I was in Berlin when I paid a million marks for an umbrella. A few months earlier, this would have been the equivalent of $250,000. A few days later, 5 million marks wouldn’t buy a newspaper. You have lived to see marks and rubles come and go, francs and liras shrink, pounds and dollars act as though they were made of rubber. You have seen stocks vanish, bonds disappear, farms go begging, banks go blooey. All the world over, those who put their faith in money, and money alone, took a terrible beating. Only those who invested their capital in the resources of their minds and the skill of their hands survived with their capital unimpaired.

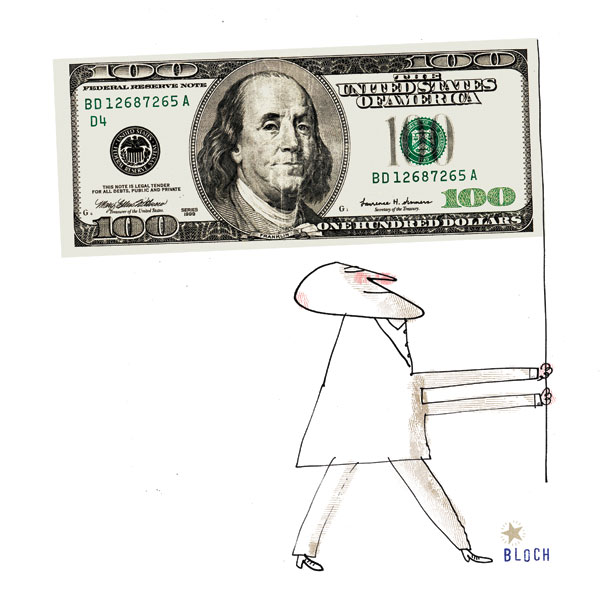

You will live another 25 years and more, God willing, and you will see a lot of changes over which you will have no control. The only ones you can do anything about are those in yourself. You can control those. You can build up your own capital by investing wisely in your own resources. You can learn trades and skills and professions. You can equip yourself to be of service to your fellow men in a dozen different ways. When a social structure is wrecked, it’s those who have who suffer most, not those who can do. Should that day ever come to you, you will be better off if you have invested your $100 in learning how to lay bricks rather than in stock in a brickyard.

So I say buy stock in yourself. Invest your money in your education. Spend it for culture. Buy knowledge and hope for wisdom. Acquire books, subscribe for magazines. Go to concerts and exhibitions and learn how to hear music and see art. Travel and study the genus homo in all his habitats. One hundred dollars invested in a bond will bring you $3 a year, unless something happens to the bond. But $100 invested in acquiring knowledge or skill will bring you dividends of pleasure and profit as long as you live. Your principal will be invested in a business you control. It will be where you can watch it. Booms can’t inflate it and depressions can’t wipe it out. Thieves can’t steal it. Sharpers can’t snitch it. Relatives can’t borrow it.

What you don’t invest in yourself, invest in others. It sounds cold-blooded, but even from a practical viewpoint, this is the best investment of all. There is no better way to get than to give, especially if you always give with the idea of helping others to help themselves. Give opportunity rather than money. Give money rather than advice. And don’t give advice.

Of course, as far as you and I are concerned, I don’t feel that this is advice. I’m just sort of talking out loud to myself. As I told you before, some people make money by saving it, others by spending it. Learning how to save and learning how to spend are two sides of the same nickel. Learning how to save is again a matter of planning. We talked that over before. How much you should save, or how little, is not nearly so important as saving something — anything — regularly.

You can deliberately acquire the habit of saving, just as you casually acquire the habit of spending, and the one habit can and will displace the other. Learning how to spend is more difficult. There is very little technique involved in deciding whether you should save 10 percent of your salary or 25 percent. But the technique of spending wisely is a lifetime study. You must know standards and appreciate values. You must learn early the difference between spending to acquire and spending to impress. Don’t be like the social climber, who spends money he hasn’t got to buy things he doesn’t need to impress people he doesn’t like.

Affectionately,

Dad

Previous: Second Job

Coming soon: The Other Fellow

America’s Wealth Gap

Will 2012 go down in history as the year money took over politics? Both parties will have spent more than a billion dollars electing the next president. More and more of that money comes from a handful of the wealthiest Americans and the corporations they run. On the Democratic side, Jeffrey Katzenberg of DreamWorks, telecommunications pioneer Irwin Mark Jacobs, and hedge fund manager James Simons have donated millions to re-elect the president, but the amount of money the Democrats have received from deep-pocketed supporters pales in comparison to what Republicans have received. A single billionaire, business magnate Sheldon Adelson, had by August spent more than $41 million and promised to spend up to $100 million defeating President Obama and other Democrats. All told, the top .07 percent of donors give more money than the bottom 86 percent. And it pays off. Candidates spend ever more time courting the super rich and then, once in office, try to keep them happy. This summer, for example, Mitt Romney held two fundraisers at which he raised almost $10 million from the oil and gas industry and then announced that as president he would end more than 100 years of federal restraint of oil and gas drilling on public lands. Things like that happen on both sides. How did we get into such a situation? What is to be done about it? Is it threatening our democracy? And doesn’t it go against everything the founding fathers stood for?

Those are big questions. The last one is the easiest to answer. Control of government by the richest wouldn’t have bothered the founders at all. It was just what they believed in. John Jay, the first Chief Justice, put it most directly: “The people who own the country ought to govern it.”

Many of the founders, including George Washington and Thomas Jefferson, were themselves among the wealthiest people in the country. They felt their prosperity made them obliged to serve their nation at the highest level. Yes, they declared independence and fought a Revolution to escape the tyranny of English monarchy and might, but they expected to replace aristocracy of birth with aristocracy of accomplishment, rule by elites who had created their wealth and influence, not inherited it. That was why they wrote a Constitution that stated the president was to be elected not by the people but by an elite Electoral College, and the Senate was to be chosen not by the people but by state legislatures. And that was why in most states only men who had money and property were allowed to vote at all.

It didn’t take long for the 99 percent of the day to rebel against that status quo. The notion of true democracy, rule by ordinary people, grew popular in the early 19th century. It was spearheaded by President Andrew Jackson, who hated bankers and banks, especially the national bank that had been founded by Alexander Hamilton. He destroyed the bank, partly to counter the power of the richest Americans. At the same time, a new generation of wealthiest Americans emerged, and they were a breed that had never existed in Europe—industrious, self-made men of humble origins, such as John Jacob Astor, a German immigrant who began working in a menial job for a fur merchant but came to dominate the trade in furs from the West, and Cornelius Vanderbilt, who rose from ferryboat captain to steamboat owner and then railroad baron. In 19th century America, the wealthiest really did have something in common with the common man.

Or at least that was true in the American North. The elite of the South were a breed apart. They grew fantastically rich and powerful from growing rice and cotton with all the hardest labor done by slaves. Seven of the first 12 presidents were from Virginia, the most prosperous part of the South. When the Civil War came, it was a fight not only over slavery but between the power of new Northern industry and urban wealth and the spoils of the Southern slave economy as well.

As extreme as the power of the wealthiest is today, it pales before that of the rich in the pre-Civil War South, for they could own human beings who had no rights whatsoever. Slave owners had such full support of the law that the Constitution originally counted each slave as three-fifths of a man for voting purposes, not so that slaves themselves could vote, but to add to the headcounts on which Congressional districts were based, giving their owners even more political and electoral power than anyone who didn’t keep slaves. Slavery was by far the highest point of the tyranny of the wealthiest in the United States.

But the kind of abuse of power that’s more familiar to us today took off after the Civil War, when four years of bloodshed costing more than a million lives left the South crippled and the North as a new industrial world power. That power corrupted, as it always does. The Gilded Age—which lasted from the end of the Civil War to 1900—was a festival of power grabs among the wealthiest. For instance, to build the Transcontinental Railroad, the owners of the Union Pacific Railroad set up a construction firm called Credit Mobilier to wildly overcharge for the work it did, just so they could bleed their own company and bondholders. Then, to make sure Congress didn’t complain, they gave assorted Congressmen both cash bribes and stock that paid huge dividends. The scam got exposed in 1872. It was estimated to have stolen $42 million in government and bondholder money, and it led to the disgrace of public figures as high up as the vice president, Schuyler Colfax.

By the 1880s the Senate was dominated by millionaires. And by 1892, wealth-fed scandal had become so commonplace that opposition to it gave rise to a new political party, the Populists, whose platform announced, “We meet in the midst of a nation brought to the verge of moral, political, and material ruin. Corruption dominates the ballot-box, the Legislatures, the Congress, and touches even the ermine of the bench. … The fruits of the toil of millions are boldly stolen to build up colossal fortunes for a few. … From the same prolific womb of governmental injustice we breed the two great classes—tramps and millionaires.”

When Theodore Roosevelt became president in 1901, he ushered in the Progressive Era, one of two major periods in U.S. history when the political tide turned strongly away from the wealthiest—the other was during the presidency of his distant cousin Franklin Roosevelt. Roosevelt railed against what he called “malefactors of great wealth” and the “criminal rich,” and he pushed through reforms like strengthened railroad regulations and the creation of the Department of Labor. A decade later, President Woodrow Wilson cemented Roosevelt’s accomplishments by establishing the federal income tax and the direct election of senators.

We know now that Government by organized money is just as dangerous as Government by organized mob.

Though none of that prevented the wild financial bubble fed by coziness between the wealthy and the government in the 1920s. So in the wake of the Great Crash that followed, Franklin Roosevelt took office in 1933 as a rich New Yorker determined to look out for the common man. He wrote to a friend, “The real truth of the matter is, as you and I know, that a financial element in the larger centers has owned the Government since the days of Andrew Jackson. … The country is going through a repetition of Jackson’s fight with the Bank of the United States—only on a far bigger and broader basis.” He raised taxes on the rich and used much of the money that came in to put the unemployed poor back to work. In 1936 he wrote: “We know now that Government by organized money is just as dangerous as Government by organized mob. … I should like to have it said of my first Administration that in it, the forces of selfishness and lust for power met their match. I should like to have it said of my second Administration that in it these forces met their master.”