No Sugar, No Tires, No Radios: Peter Drucker Predicted Shortages in 1942

Not all Americans were personally affected by the fighting in World War II, but all had to deal with wartime shortages of consumer goods. Manufacturers were diverting more of their raw materials and manpower to filling military contracts. Production of consumer items had fallen or, in some cases, stopped.

Normally, shortages drive up prices, making products unaffordable to a larger percentage of the population. In order to ensure an equal distribution of goods in limited supply, the government began rationing programs.

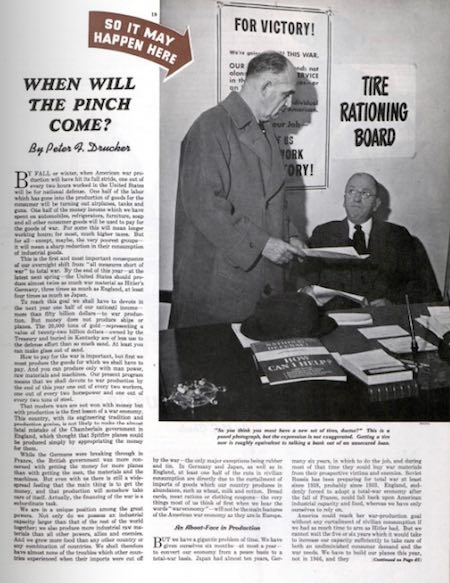

Just days after the Pearl Harbor attack, the Office of Price Administration (OPA) began to ration the sale of tires. America’s chief source of rubber had been lost when the Japanese seized Malaya and the Dutch East Indies. By limiting the supply of tires, the government also hoped to reduced gas consumption by motorists.

The OPA set up ration boards across the country, staffed by 7,500 volunteers, who determined who would get the rationed tires.

In January 1942, the War Production Board took a similar approach to the auto industry. It ordered an end to unregulated sales of automobiles to civilians. Ration boards would now determine who could buy any of the 500,000 new cars made before the auto industry switched completely to defense work.

Seventy-five years ago this week, in the March 7, 1942, issue, management pioneer Peter Drucker told Post readers that sugar rationing would soon begin. In his article, “When Will the Pinch Come?” he listed several goods that wouldn’t be produced until the war was over: refrigerators, vacuum cleaners, washing machines, air conditioners, sewing machines, irons, radios, and phonographs.

His article must have raised more than few eyebrows when it was published. The real shortages, said Drucker, were just beginning. They would be significant by Christmas.

The shortage of goods must have struck many Americans as ironic. They had waited through the 1930s for a return of good wages. Now, with incomes rising and money to spend, the luxuries they’d waited to buy were unavailable.

In this knowledgeable analysis, Drucker explains how rationing and the war economy would affect business. The American economy would undergo “great and violent changes” in 1942. There would be shortages, but he didn’t anticipate real hardships. At worst, he said, the average American would “live briefly as his grandfather lived all his life.”

Featured image: National Archives

The Case of the Missing Prosperity: An Economic Mystery from 1952

Back in 2008, when America’s economy began crumbling, financial experts swarmed into the media spotlights to explain what was happening. “High-risk investing by deregulated banks,” they said, and “collateralized debt obligations.” Few people understood what they were talking about, but we had an explanation, and that was better than nothing.

Two years on, the economy continues to weaken, unemployment grows, the average American’s purchasing power drops, mortgage defaults rise, and the American Dream seems smaller and more fragile than ever. Experts talk of “credit default swaps” and a “Troubled Asset Relief Program,” but the problem seems impossible to pin down.

The birthday of Peter Drucker, November 19, is a good reminder that experts in management and economics haven’t always been incomprehensible. Drucker, the pioneer of management consulting, always managed to discuss the world of finance clearly and readbly, without oversimplifying.

Drucker was a frequent Post contributor in the 1940s and ’50s, when he was starting to advise major U.S. corporations on management policy and corporate structure. He saw trends long before they became obvious to American businesses: decentralizing, outsourcing, even the rise of the “information economy.” (What Drucker meant by “outsourcing” was the practice of hiring skilled workers from contractor agencies, not the newer meaning of exporting of American jobs en masse to cheap labor markets overseas.)

When he died at age 96, he was widely considered as a pioneer in management, and a man who was usually proved right.

To honor his birthday, I could have excerpted any of his incisive, highly readable studies of the German and Russian economies during World War II, or his thoughts about profits and inflation in the U.S. economy. Instead, I have chosen a historical mystery with unintended poignance: his 1952 article, “Look What’s Happened to Us!”

The subhead for the article prepares the reader for some unusual content:

Our kids have a better chance of success than ever before— yet shocked Europeans look at how we have changed and say, “This is worse than socialism!”’

Drucker, though, is no sensationalist. His article describes how the American economy of 1952 has become a powerful force for democracy by promoting wealth AND equality.

If you are an American and over twenty-five you have taken part, knowingly or unknowingly, in “one of the greatest social revolutions in history.” This summing up of the last quarter century of American history does not come from a Hollywood press agent or from a Fourth of July orator. It came, a few months ago, from the National Bureau of Economic Research, for the last twenty-five years the country’s leading student of long-range economic trends, and an outfit so ultra-scholarly, austere and publicity-shy that the most extreme term it had ever used before was a restrained and barely audible “statistically significant.” The development that provoked such unscholarly language was the change in the distribution of income during the last generation. It is indeed an amazing change.

The income gap between the rich and the poor, Drucker states, is shrinking.

More than half of the nation’s families now have a middle-class income—as against a quarter of the population fifty years ago… The further down the income scale we go, the greater, by and large, has been the rise. The 1900 dollar bought about three times what the 1951 dollar buys [but] the yearly income of the factory worker has gone up six-fold, from around $500 in the days of Andrew Carnegie and John D. Rockefeller, to $3,000 or more today.

The increasing wealth of workers is part of a revolution in the idea of capitalism.

We have produced a capitalist system in which ownership rests with the mass of the people. Individual horizons have steadily broadened—indeed, the progress toward equality of opportunity has, as befits a free country, been at least as fast as that toward equality of income or wider distribution of wealth.

The very term “capitalism” has come to mean something new. Formerly it expressed an all-but-complete divorce between the good of business and the good of the economy—if not an irreconcilable conflict. We now believe that there must be harmony between the ends of business and the good of society in the interest of both.

An illustration of this new idea is in business’ new concept of people. Fifty years ago the emphasis was on labor as a cost; today it is increasingly on human beings as a resource—and the scarcest, most important and most productive resource, at that.

Two years ago, well before Korea, the president of one of the largest steel companies asked some of his vice-presidents to figure out how much additional steelmaking capacity the company should build. In the letter in which be gave them this job, he said, “Do not start your figuring with the question of what capacity would be most profitable for our company. Start with the question how much steel the country will require to be strong and prosperous, and then work back to find out how much of that total our company should aim to provide.”

A visiting French steelmaker who chanced to see the letter was quite shocked. “This is worse than socialism,” he said. And, indeed, the approach would have appeared as eccentric to the men who ran the same steel company twenty-five years ago, and would have been hardly even conceivable to the men who ran it fifty years ago.

This philosophy rests upon the conviction, buttressed by experience, that the only line of action that will pay in the long run is that which serves American society as well as their own company. Socially irresponsible action… simply does not pay.

We believe that the businessman must act responsibility—not just because his own business aim demand it. We no longer believe that there is a cleavage between the demands a business makes on a person as a businessman and the demands society makes on him as a citizen.

We are learning fast that the human being is the most important, the most productive and also the scarcest economic resource… During the last ten years or so it has become almost a commonplace in American business that the job of management is the leadership of people rather than the working of property.

It has always been a distinct trait of American business, and of American business alone, that it believed in the opportunity of the man at the bottom to rise to the top. But it is only now that American business is going out systematically to find the men of ability, initiative and ambition in plant or office, to train them and to give them a chance to grow and to advance.

Peter Drucker was neither an idealist nor an optimist. He saw the problems of modern business more clearly than many of his contemporaries. Business executives paid him large sums of money for his penetrating assessments. Yet here he is, explaining how American business has become socially responsible, and inspired by a sense of ethical pragmatism.

Was 1952, in fact, the year that corporations began balancing social good with stockholder returns? Did Drucker really have evidence for his claims of corporate altruism? If so, how did social trends turn around so completely?

We like to believe that life in America generally gets better over time: Each generation enjoys a little more prosperity and freedom than its predecessor. If Drucker’s picture is accurate, businesses and workers in America have been passing through a long decline.