Just about every American can cite a personal example of the staggering benefits—and equally staggering costs—of today’s medicine. Here’s mine: My older brother Stephen was diagnosed more than 40 years ago with Crohn’s disease, a devastating chronic abdominal illness that had no cure and no good treatment. He was a teenager then, and he led an adult life of constant pain. He finally died of colon cancer at the age of 44 in 1996. Six years later, in 2002, I too was diagnosed with Crohn’s after worsening abdominal pain and bleeding left me bedridden. I had to be hospitalized for two weeks, but in the hospital I began treatment with a new cutting-edge biological drug called Remicade that had been introduced after Stephen died. Within months my symptoms were virtually gone, and I have been in robust health ever since. I was saved, miraculously, in a way my brother never could be.

Here’s the catch: There’s still no cure. I need a Remicade treatment every eight weeks. I learned when I left the hospital that it was going to cost more than $3,000 for the drug and $800 for the doctor’s services every time. Since then the price has risen to where the hospital at which I get treated puts in a claim for $22,000 and my insurer usually settles for around $11,000, or about $70,000 a year. To my immense good luck, I have a generous employer with a great insurance plan that makes it all affordable. But I only go through with it because it is truly a matter of life and death, and I have lived in fear of not having a job and being unable to buy insurance to cover such an absolute necessity, all because of some not-yet-understood flaw in my DNA.

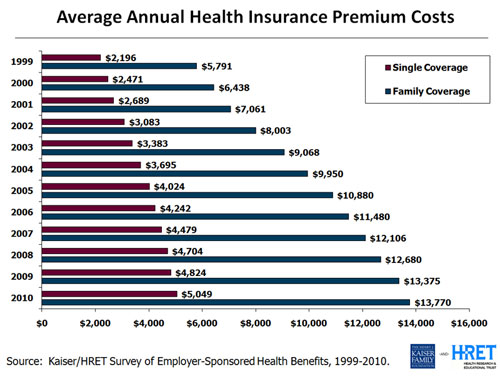

Healthcare in America works for individuals like me—most of the time—but for our nation at large, the system is broken. As we near the last weeks of a bitter presidential election campaign, there are many differing views about why it is broken, what it will take to fix it, and whether the Patient Protection and Affordable Care Act (PPACA)—informally known as Obamacare—is the answer, but the fact of its brokenness is not in dispute. We spent more than $8,000 per person on healthcare per year in 2010, according to Centers for Medicare & Medicaid Services, more than one and a half times as much as people in any other nation, and that amount has been rising faster than anywhere else. It is eight times what it was in 1980. Yet we don’t have better health as a result. Our life expectancy is lower than in any other advanced nation. And with about 50 million of us uninsured—also unique among first-world nations—horror stories abound. Any of these uninsured Americans would be devastated economically as well as physically by the disease I have—or by any other chronic disorder. And, indeed, more than half of all American personal bankruptcies are caused by healthcare costs. How did our healthcare system become such a wreck? And what is to be done?

A century ago, medicine was both very primitive and very inexpensive by today’s standards. When people became very ill, little could usually be done. They either got better or they didn’t; they lived or they died. We all have grandparents who succumbed quickly to heart disease or cancer or other illnesses but today would likely be kept alive and returned to health at very great expense—to go on to incur further high expenses the next time something goes wrong. Last month my father had bypass surgery at the age of 89. That would have been unimaginable a generation ago. A friend of mine just had a hip replacement at the age of 95.

American-style health insurance, which covers too few people too expensively, began as a strange byproduct of World War II economic sanctions, of all things. During the war the government froze the wages paid by employers, but it didn’t freeze fringe benefits. Companies that wanted to compete for employees did what they could to offer them something special—they began giving them health insurance. And so the system we all know, employer-backed insurance policies handled by private, profit-seeking insurance companies, arose, not from a plan but as an odd spin-off of wartime price controls.

By the 1960s, many working Americans had sufficient insurance through their employers, but the poor and the aged did not. That was why in 1965 President Lyndon Johnson pushed through the bill that created Medicare and Medicaid. Medicare was designed to cover the elderly and the disabled; Medicaid insured the poor. With them in place, most Americans had health insurance at last.

But the unending, growing stream of new technologies and new pharmaceuticals was setting the cost of medicine on an inexorable upward path. Health insurers, wanting to keep their costs down and profits up, started charging people different amounts for coverage, according to how risky they appeared to be, and avoiding the riskiest customers completely. That meant that the people who need insurance most have the hardest time getting it, and when people don’t have insurance they wind up going to emergency rooms more and incurring even higher costs. And, let’s be clear about this, these higher costs get shared among all the rest of us. Congress passed the HMO Act of 1973 to promote health maintenance organizations (HMOs) that could negotiate with doctors and hospitals to set lower prices. But HMOs had every reason to simply minimize treatment, and many of their customers came to feel they were being forced to accept second-rate care. The failed Clinton health reform plan of 1993 tried to fix that, but it was hopelessly complicated, devised in secret, and never even reached a vote in Congress. The next attempted solution was PPOs, or preferred provider organizations. They have generally meant more generous coverage for employees but even higher costs for employers, who have responded by raising their premiums and deductibles or even dropping insurance altogether. And so everyone’s costs have kept going up, and more Americans have become uninsured.

With costs going up everywhere, why do we in the U.S. pay more and get less than anyone in any other advanced nation? Because our accidental, improvised system pits doctors against insurers against patients. It is broken. Doctors earn the most when they do whatever costs the most, regardless of results. Insurance companies wage constant battles against doctors and hospitals to pay as little as possible of those unrestrained costs. And patients have little way of understanding what treatments they really need, what anything will cost, or what they can do about costs once they hit.

Ultimately the cause of this chaos is our belief that a free market is the best way to organize and regulate the system. We believe that if we can figure out how to create a smoothly working market for healthcare, just as we have for food and housing and automobiles, our problems will take care of themselves. But as was first explained in 1963 by Kenneth J. Arrow, a Stanford University economist who would later go on to win a Nobel Prize, that’s simply not possible.

Become a Saturday Evening Post member and enjoy unlimited access. Subscribe now

Comments

Clearly, Samantha lives on a different planet than me. I wonder where? Or more likely, I wonder where I am? Potato chips cost more because of food stamps. On my planet, that’s just shockingly _____________ (you fill in the blank.)

Maybe its just me, but this should be a no-brainer. We, the USA, are never going to get respect from the rest of the World, be recognized as a Super Power by continuing with this craziness. Healthcare. Everyone should have a right to it-EVERYONE. Free, or affordable. Rich, poor, young, old…..very sad, and neither party has even come close to fixing this….

Once again I read another commentary on Health care problems….and It ends as most do….ie, the COST OF MEDICAL CARE…..When are we going to stop sympathizing witn our poor doctors and nurses….We seem to think that we must pay them what they want, not based on the value of their time (which is only slightly more that the time spent with other service providers) and their threat that they will go out of business if their practice depends on Medicare approved payments…..ie, they will not make as much money as they would like to make….not whatever they deserve for the service they have provided and the time it took them to do so….This same applies to all institutions (hospitals, nursing homes, etc) and their staff…..they want to make as much money as any one will pay…..regardless of their often “nonprofit statis”. The whole system is out of whack and goverened by regulations which encourage indiviual greed…..

Quote:

“To my immense good luck, I have a generous employer with a great insurance plan that makes it all affordable.”

$70,000 annually is not affordable no matter who is paying. Either taxpayers or consumers are the ones, in fact, who are footing your own health-care costs. You seem to exempt yourself from the fact that your costs are not a burden for all of us, in the same way that are ER visits that go unpaid. Even if Medicare was made available to every citizen, it’s still the taxpayers and consumers who are the real payers. In the same way that the $102 million executive is a costly middle man, so is the government with Medicare. It’s meaningless to have any middlemen, at all, between patients and providers. For those with catastrophic illness, let the government come to their aid in the same way that FEMA comes to the aid of natural-disaster victims.

If Medicare and insurance (for sneezes and head colds) had never been introduced, health care would still be affordable enough for each person to pay his own way for everyday healthcare.

Another truth that fails all, is that the billions spent on health care does not go into pockets of consumers, but into the pockets of health-care professionals, instead, professionals who are driven by greed to cheat patients, the government and insurance companies, alike. Doctors, for example, used to live across the street from us; now they’ve all moved into multi-million dollar homes in gated communities, dining in four-star restaurants each evening where servers would rather mug them than smile — all on the backs of taxpayers and consumers.

“…smoothly working market for healthcare, just as we have for food and housing and automobiles”

You’re kidding, right? You could’ve purchased a homee for cash in the 50s for little more than a year’s wages; today, the same home requires all of 5 to 6 year’s of wages, and if you count interest, 10-15 years. A car from China costs $2,000. Here: 10 to 20 times more expensive. Potato chips have risen even faster in price, thanks to food stamps that have increased demand. Since Obama, food-stamp costs have spiraled, yet no one can connect the dots to the spirally cost of food. There has been nothing smooth about food, housing and automobiles.

Talk computers and consumers electronics, instead, and now you’re talking about smooth. A color TV in the 60s cost $1,200. In constant dollars today, it translates to $10,000. I just bought a new flat screen for less than $400. In 60s’ dollars, it translates to less than $40.