In mid-October, 1907, the price of copper fell, taking down several investment trusts and banks with it. The New York Stock Exchange tumbled 50%. Thousands of bankruptcies followed and unemployment more than doubled.

The Black Tuesday crash of 1929 came on October 29, when the market dropped 12.8% and launched the Great Depression. The GDP fell from $103 billion to $66 billion, almost half the banks in America failed, and unemployment reached 25%.

On October 19, 1987, the Dow Jones Industrial Average had its biggest single-day decline. Analysts blamed computerized buying and selling programs for taking the market down.

Is October unlucky for Wall Street? Some market analysts thinks there’s enough of a link between downturns and the month that they refer to the “October Effect.” But is there really a pattern here?

Skeptics say the number of October disasters is merely coincidence. As Stephen Williamson, former vice president of the St. Louis Fed observed, “Stock market crashes have occurred sufficiently infrequently in history that there is not enough evidence on when they are more likely to occur.”

Perhaps the frequency of market crashes in October is mere coincidence. But Peter Day of the BBC thinks there may a cause behind them, suggesting that culprit might be unrealistic expectations of future performance made before summer holidays. Stock brokers go off on vacation with visions of high returns dancing in their heads They return to work, review their stock returns, take a look at the approaching end of the year, and over-react.

Lily Fang, a professor of finance at INSEAD who has studied the market’s performance in September and October, has observed that stock returns are measurably lower than at other times, possibly because it follows the season of school holidays, when many brokers and analysts take time off,. The pattern is seen in all global markets. Brokers pay little attention to the market during the summer and, as they return to work, are slower to react to information, particularly bad news.

Yet another theory for October’s poor performance is that the stock market still follows a historic pattern of rising prices in spring and falling prices in fall. The pattern was set in the days when the market was dominated by farmers’ growing seasons. Money was available in spring to buy seed and tight in fall when loans were repaid. This rise and fall of the market, according to this theory, has continued to this day.

But since we’re considering unprovable theories, we should mention some of the classic superstitions of Wall Street:

- The construction of enormous buildings usually precedes a market plunge (e.g., Empire State and Chrysler Building preceded the ’29 crash, and Dubai’s Burj Khalifa, the tallest building in the world, was completed just before the 2008 crash).

- The market does better under a new moon and worse under a full moon.

- An AFC victory in the Super Bowl means a bad year for the market.

- You can make money selling stock on Rosh Hashanah and buying it back later in the month, on Yom Kippur.

And if you believe any of these, call us. We have some great deals on some penny stocks to sell you.

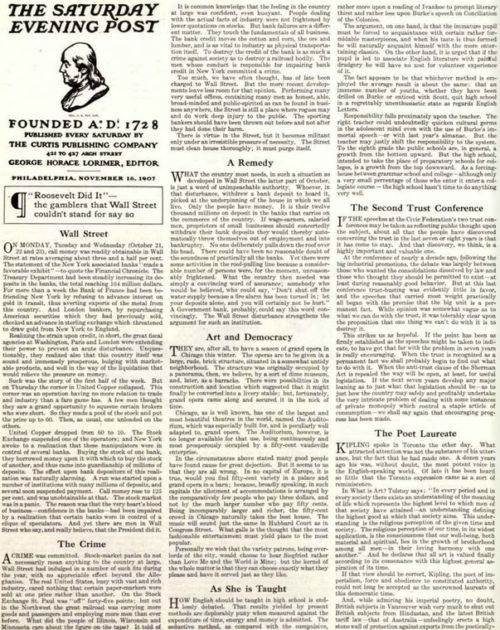

Read the Post editorial from the November 16, 1907, issue. The editors said the reason for the 1907 crash was that “the very heart’s blood of business—confidence in the banks—had been impaired by a realization that certain banks were in control of a clique of speculators.” (Members: View entire issue.)

Read the Post editorial from November 23, 1929. A month after the collapse of the stock market, Post editors (erroneously) saw blue skies ahead, agreeing with a leading authority that “business has been maintained for the past few years on a high, but not exceedingly high, level, with brief periods of contraction to which the term “depression” seems scarcely applicable.” Despite their sunny outlook, a 12-year depression to followed. (Members: View entire issue.)

Featured image: Shutterstock

Become a Saturday Evening Post member and enjoy unlimited access. Subscribe now

Comments

This is a question that is ultimately a riddle, the connection between October and Wall Street. I don’t trust Wall Street any further than I could throw it to invest money, in this month or any other—-ever!