Much in America has changed in the last 50 years, including the process of getting a college education. Over the past five decades, earning a diploma from a good college or university has become more important and more competitive. And much more expensive. How did the pursuit of higher education mutate so much in half a century?

The necessity of a college degree is reflected in the growing number of jobs requiring one. According to a Georgetown study from 2010, by 2018 more than 63 percent of all jobs would require a college education. In contrast, in 1970 only 26 percent of middle class workers has any education beyond high school. (In a recent reversal, employers — including leading Fortune 500 companies — are responding to a shortage of talent in their workforces by dropping their degree requirement.)

And more students are competing for enrollment. In March of 2021, Common App (a standardized application form used by 900+ colleges), showed over six million first-year students applied to college and universities, an 11 percent increase over 2020.

Finally, there’s the expense. Consider this: The University of California was tuition-free until the 1980s. Since then, the state has sharply reduced its support. Now, an in-state student’s annual expenses for tuition, room, board, and textbooks is over $35,000. The situation in California has been replicated in every state. The reasons are manifold: reduced state funding, a lack of alternatives, growing demand, and higher costs for personnel, recruitment, student amenities, and technology.

Consequently, 43.2 million Americans now have unpaid student loans for their time at colleges and universities. On average, each student carries a debt of $39,351. All told, the nation’s student-loan debt is over $1.5 trillion. Considering the difficulty young people face in clearing these loans, that debt represents a liability in the U.S. economy. And these obstacles don’t even include students’ academic challenges.

So why do so many students still make a college degree their goal?

Partly because, since the late 1940s, it was a common standard of achievement.

It was different back in the 19th century, when a college degree conferred limited prestige. Colleges mostly instructed small numbers of students who were headed for low-paying positions as church ministers or educators.

But by the turn of the 20th century, colleges began developing business curricula to prepare students for the modern world of science, finance, and manufacturing.

Businesses soon began to recognize the advantage a college education gave an employee. A February 5, 1921, Post article, “What a Man Gains in Going to College,” reported that a New York transit office was paying $982 a year to men whose jobs required only reading, writing, and arithmetic. For positions requiring two years of college or technical education, the salary started at $2,400. Another company with 17,000 employees annually paid $3,000 to their top 300 employees, of which 286 had college degrees.

With such inducement, college enrollment in the 1920s grew from 600,000 to one million.

By 1927, according to the Post article “Everybody Goes to College” by Albert Atwood, hundreds of colleges were rejecting between 2,000 and 3,000 applicants every year. Some colleges were turning away between 50-80 percent of their applicants. In 1926 alone, more than 15,000 applicants who had met college requirements were rejected.

In 1944, the world of higher education was transformed with the Servicemen’s Readjustment Act of 1944, popularly known as the G.I. Bill.

It provided veterans $500 a year for college, with additional funds for room and board. Almost 8 million enrolled — nearly half of all returning veterans.

At first, the post-war wave of students threatened to overwhelm colleges, but states, eager to support the college initiative, added their own financial support to expand campuses and facilities.

The federal government next extended financial support to civilian students with the Federal Perkins Loan program, and to women and minorities with the Higher Education Act of 1965.

Then, in the early 1970s, the situation changed again. Double-digit inflation, a stagnant economy, and an oil embargo caused state governments to cut back their support of colleges and universities. Students were expected to make up the difference. Since then, tuition has risen so sharply that, for several years, it has surpassed the rate of inflation. On average, college tuition has more than doubled since the 1980s.

Even so, a college diploma has continued to be regarded as a valuable achievement in the eyes of students and, it is hoped, potential employers. In 1988, 20 percent of adult Americans had a college degree. By 2019, that figure had risen to 36 percent.

Colleges are well aware of the higher cost of higher education, and many institutions are working to make courses more affordable.

The James G. Martin Center reports that at the University of Cincinnati, the president turned down a salary increase and bonus pay, and the school sold its presidential residence. Temple University was among the first to eliminate varsity sports programs to save money. And Seton Hall University has begun offering lowered tuition to students with a high school GPA of 3.0 or higher.

Students are also looking for less costly options, such as taking their required, entry-level courses at inexpensive community colleges.

But many are growing frustrated with insurmountable debt and poor employment prospects. Will there be a major paradigm shift in higher education? Whether that change comes from student side or business side, the 21st century has taught us that the middleman is often in peril. Unless things change, a traditional college education may go the way of the record store and the yellow pages.

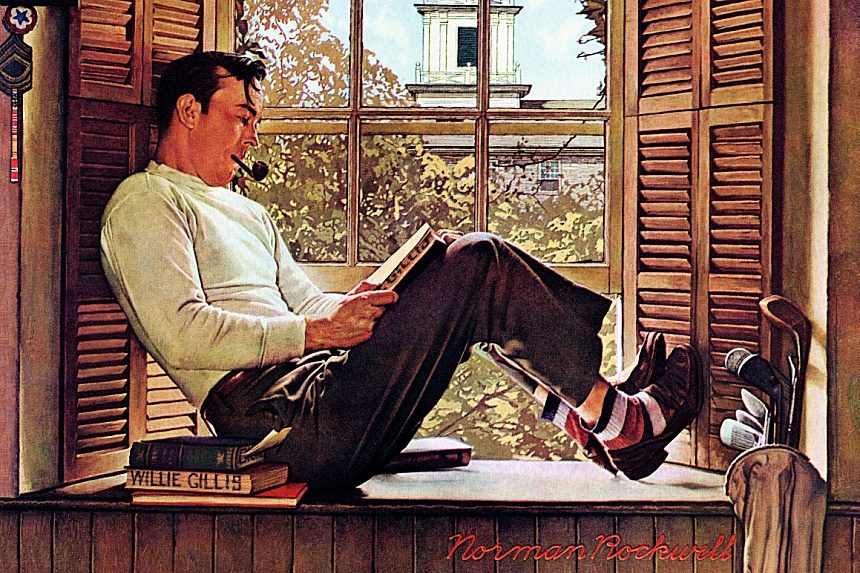

Featured image: Saturday Evening Post cover by Norman Rockwell from June 6, 1959 / Pixabay

Become a Saturday Evening Post member and enjoy unlimited access. Subscribe now