January 18, 1930

September/October 2011

October 6, 1945

July/August 2009

January/February 1993

May/June 2009

Become a Saturday Evening Post member and enjoy unlimited access. Subscribe now

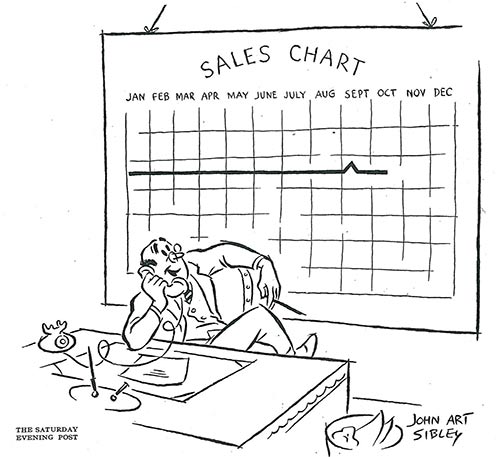

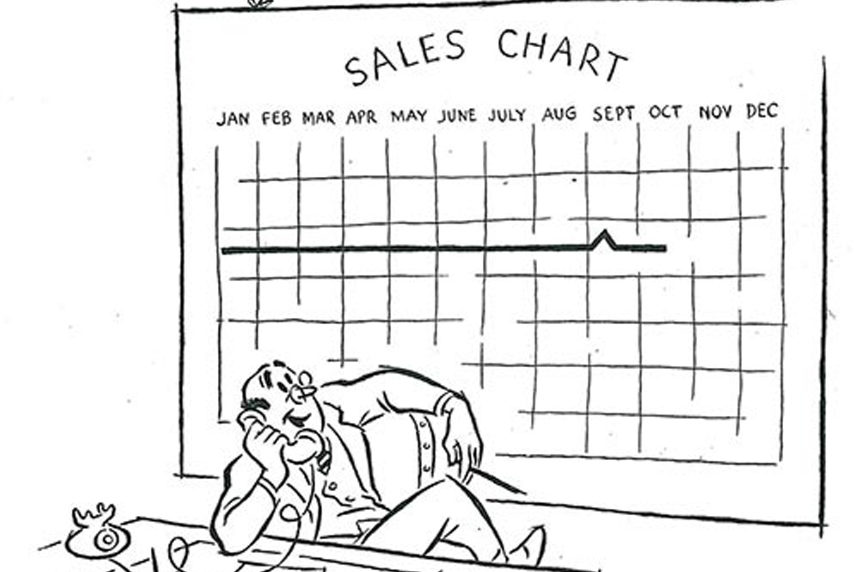

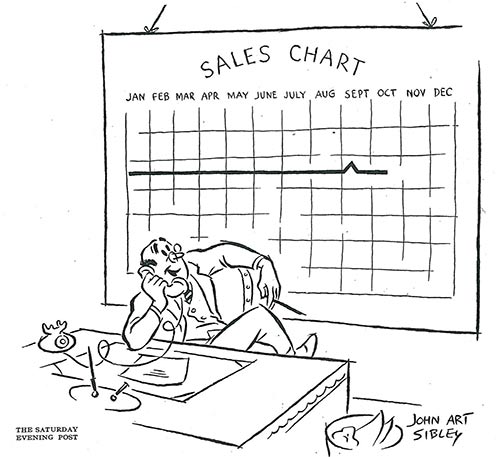

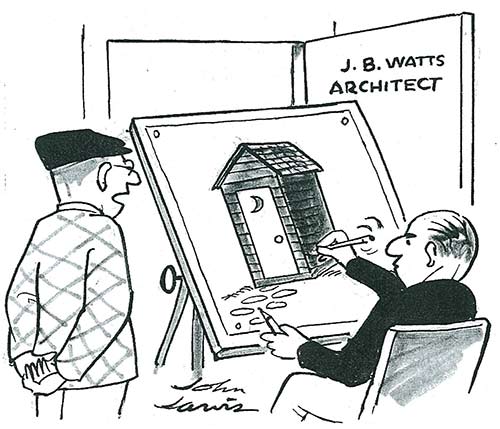

The stock market may be down and your earnings report may be dreary, but these cartoons will make you laugh like nobody's business.

January 18, 1930

Become a Saturday Evening Post member and enjoy unlimited access. Subscribe now

Comments

“In the early autumn of 2008, mayhem swept through global financial markets. It engulfed AIG on Monday morning, September 15. Lehman Brothers had just failed.” hrmm, try starting your career at this very moment in 2008. Then as a result, doing the work of 4 people with no support, underpaid, and getting sick from stress. And yes knowing full well this was coming but had no control over things. Then getting laid off and never having been able to save for the future because you are only in your early 20’s. You are finding other jobs yet those companies laid off full departments or don’t exist anymore and never moving up in your career… laid off 4 more times and can only find part time work as a contractor – no benefits, nothing. You have the skills and were a top performer plus have a highly desirable degree from a top school, 10 years later your career doesn’t exist. You were told you belong somewhere else and you are overqualified. Count your lucky stars you were not a millennial who couldn’t move up because older workers put off retirement. I wouldn’t complain if I were you. Still working? There’s still a cash flow. For some that doesn’t exist at all. Count your lucky stars you have money to eat.

#RobMcGowan Jr Right, Bob. Some of us saw what was going ahead of time, Remember the Battle in Seattle when protestors of the WTO meeting tried to tell the rest of the US that a WTO agreement would send jobs overseas and the apathy from “college” educated thought there jobs were safe, Many of them are not laughing now since they had to train their younger replacements before the company “reorganized.”

I was and RN and should have been fine. Lived in WA from 85′ to ’12 in a up and down marriage to someone who snuck drinking (I hadn’t a clue…) who eventually became more abusive over time. To make a long story short by the time we divorced my health waas not good enough to take the house and do yard work and such so I gave it to him . . . but he moved in with his girlfriend who he married a few months later and let the house go into repo. Although, the judge said he was fully responsible they listed me on it also as a default. Thankfully I have built my credit back up to excellent and his is still crap.

I kept an eye on rental markets and all the repo’s in my old middle class neighborhood. The homes were NOT put on the market . My neighbor’s gave there back to the bank willingly when he lost his job and it was move-in ready. A beautiful home, so why was it never listed?

I will tell you what I think. Knowing I would an apartment soon I kept me eyes on the rental market. Hardly a home to be had, 98$ of the market was apartments and by the time I had to leave our home rents in apts. were up about 35%. However, when the “crisis had slowed down” signaling the worst was over. . .there were a hell of a lot of single family homes for rent by Realty and Management corporations. AND ON TOP OF THAT. . . .,

I stumbled upon a Stock market chart that showed “Rental Property” stock began to plummet in 2004. I think

the entire thing was planned.

So, like so many I worked my butt off since the age of 16 at some job or the other, trained as a nurse when I was 28 – 31, and because I was an idiot and married the wrong person lost everything I worked for. Not feeling sorry for myself, just kicking myself for the choice made. Now I tell all young people to NOT marry until you see them daily for 2 years to know who they really are. I dought anyone can fake it that long.

These are all great cartoons, but my favorite here is the bottom one from 2009. It’s not funny like the top two. It’s funny in that it’s so true it makes you laugh for that reason!

I don’t know anyone that can relate to the TD Ameritrade (and its competitors) ads about investing ‘your little nest egg’. WHAT ‘little nest egg’??! They’re talking about $100k or more you have lying around to invest in this or that, here and there for (hopefully) a nice future return.

Sounds great doesn’t it? Except for the relatively few who keep these companies in business, most of us are having to work more hours/jobs just to keep our heads above water; especially in my VERY oxidized once ‘Golden State’. As for Wall Street/stock market, forget it!! I’m better off with the occasional gamble in Las Vegas ($50 limit) strictly for entertainment every now and then, while there.