You’ve probably heard that with every challenge comes an opportunity. That idea was certainly true for the U.S. economy in 1914: the country was in a recession, the Great War in Europe was raging, and Wall Street was confronting a massive sell-off of U.S. securities by other countries, potentially leading to a financial disaster. In other words, America was handed a big bunch of lemons.

The drastic measures that the U.S. government undertook to avoid a calamity are mind boggling by today’s standards. The story involves war, gold, and a shrewdness about the future of the world economy.

As the Great War approached, dozens of countries saw financial panics arising from bank runs or stock market crashes. Even the Bank of England had to temporarily shut its does for the first time in its history.

America was far from the conflict, but it felt the effects of the European markets. Foreign investors sold off $3 billion of their U.S. stocks, converting assets into gold, which had a fixed value because of the gold standard. Gold was leaving the country at an alarming rate, depleting American reserves.

This left foreign investors wary of U.S. currency. They knew America was prone to occasional financial crises. The last one, just seven years earlier, had led to a serious recession. Now investors were hearing rumors that America would abandon the gold standard, which would have been a blow to the international status of the dollar. The trading value of the dollar began to fall.

The hero of this story was Treasury Secretary William G. McAdoo. He realized that if America lost so much gold it couldn’t back its currency, the U.S. would have to quit its gold standard. But if it could hold its place while other nations were abandoning gold, it had the chance of emerging from the war as a major financial power. Further, the U.S. needed its gold to launch the Federal Reserve system, another of McAdoo’s projects that would ensure a more stable monetary and financial system.

McAdoo started several programs to strengthen investors’ faith in the dollar, including providing enough gold for regional banks to use in currency exchanges, establishing a gold fund for foreign creditors to assure them that their debts would be honored, and promoting American exports of grain and cotton to Europe to offset their sales of U.S. securities.

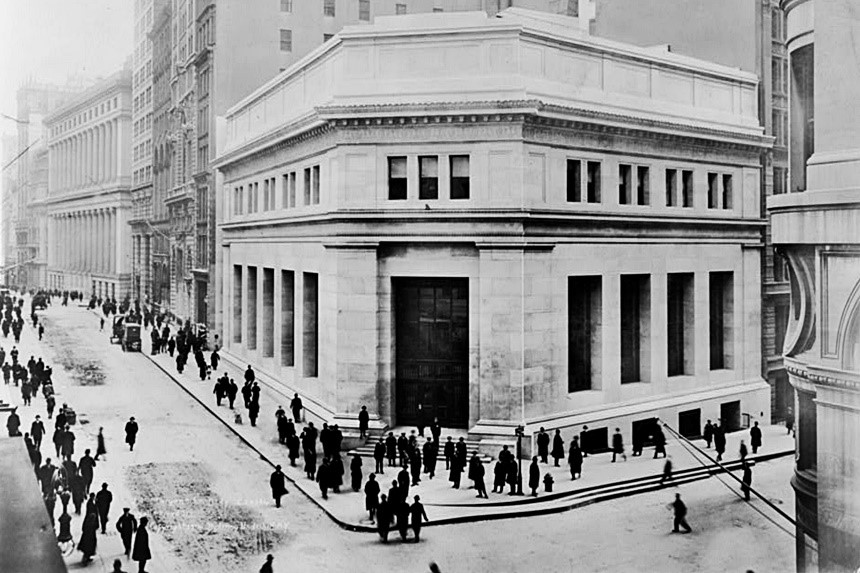

Most memorably, though, he closed the New York Stock Exchange “until further notice” to impede foreign access to U.S. gold. On July 31, 1914, the New York Stock Exchange shut down all trading, reopening for bond trading only on November 28, 1914. Stock trading — with limitations — returned on December 15. Shutting down the stock market tied up American as well as foreign money. Knowing that this national loss of liquidity could lead to runs on banks, McAdoo issued a supply of special Federal Reserve Bank Notes. Once depositors knew they could get their money out of the bank, panic subsided, and bank failures were avoided.

Within eight days, trading unofficially resumed. A number of brokers hung about in New Street, behind the stock exchange, making trades. At the height of activity, 35 brokers were working the New Street exchange, trading up to 40,000 shares in a day — all cash transactions. McAdoo permitted them to operate on the street on condition that, to prevent panic, their stock prices would not be reported in the papers.

McAdoo managed to bring back investor confidence and kept the dollar on the gold standard. By the end of the war, the U.S. and Great Britain were the only nations still adhering to the gold standard; all other nations had been forced to abandon the policy.

While Britain still backed its currency with gold, its gold reserves had been diminished. To keep gold in Britain, its Treasury now restricted the amount of gold investors could take out of the country. The pound had had lost value against the dollar, partly from the large debt to America that Great Britain had run up during four hard years of fighting. America, on the other hand, had become a creditor nation. It had taken advantage of its nearly three years of peace to build its global banking system.

The world had come to London when it sought financing before 1914. Now investors were turning to New York instead. The global financial capital had moved from the old world to the new, and the dollar had replaced the pound as the most accepted global currency. The U.S. was now the world’s largest economy.

Now that was some remarkable lemonade.

Become a Saturday Evening Post member and enjoy unlimited access. Subscribe now

Comments

A very interesting feature on the U.S. and Britain’s economies during the 1910’s. The headline here was too irresistible and appealing NOT to read. If only The New York Stock Exchange could be shut down again, permanently, but of course it can’t. Not without unprecedented calamity we’re always teetering on the edge of as it is.

Nixon took the country off of the Gold Standard 52 years ago for reasons he felt were necessary at the time. Economics (historically) is hard to control and predict. Certain things though started at that time that have only gotten worse over the past 5 decades. The average American getting the shaft by the corporations and government the latter is completely beholden to, not to mention Wall Street, the military industrial complex and bio-pharmaceutical complex.

A nightmare, permanent Gilded Age for the privileged few now calling all the shots. The monsters comprising the World Economic Forum with no limits of power. NATO squashing any/all chances of peace. Trillions going to Lockheed-Martin, Raytheon, Northrup-Grumman for new military equipment to be sent to Ukraine only to be destroyed starting the cycle over again. Endless undeclared ‘wars’ the U.S. has no business being in, except it’s ONLY about business and profit. America can go to hell as far as both political parties are concerned, which is one large singular party anyway.

The pharmaceutical complex is working as hard as possible to get children on an opposite gender regimen as early as possible to get them on maintenance drugs for life. Side effects? More drugs for that. There’s no such thing as the bottom, nothing’s too low for them. People need to be questioning everything now, like a hawk. Watch what they do, not what they say.